Securing Critical Minerals

for Washington State

Mapping the vital inputs fueling the innovation economy

Produced by FP Analytics, with support from

February 2023

Governments and businesses around the world are increasingly concerned about the resilience of critical minerals supply chains. While they may seem obscure, critical minerals play a vital role in the manufacturing of many modern technologies and essential products, including semiconductors, jet engines, electric vehicles, hydrogen electrolyzers, and wind turbines.

Broadly speaking, critical minerals represent crucial inputs for advanced technology manufacturing and are considered essential to economic and national security. Currently, the U.S. Geological Survey (USGS) specifies 50 minerals in its regularly updated list.

Multiple key industries within Washington State’s high-tech economy are dependent on these critical minerals, including transportation, zero-carbon electricity, tech and data centers, and aerospace and defense. This makes Washington state comparatively more dependent on these supply chains than many other states, with direct impacts on its economy and environmental goals.

Critical Minerals for Washington State’s Economy

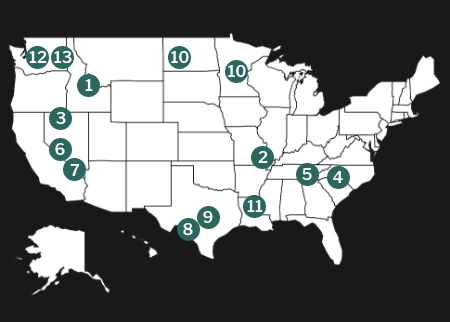

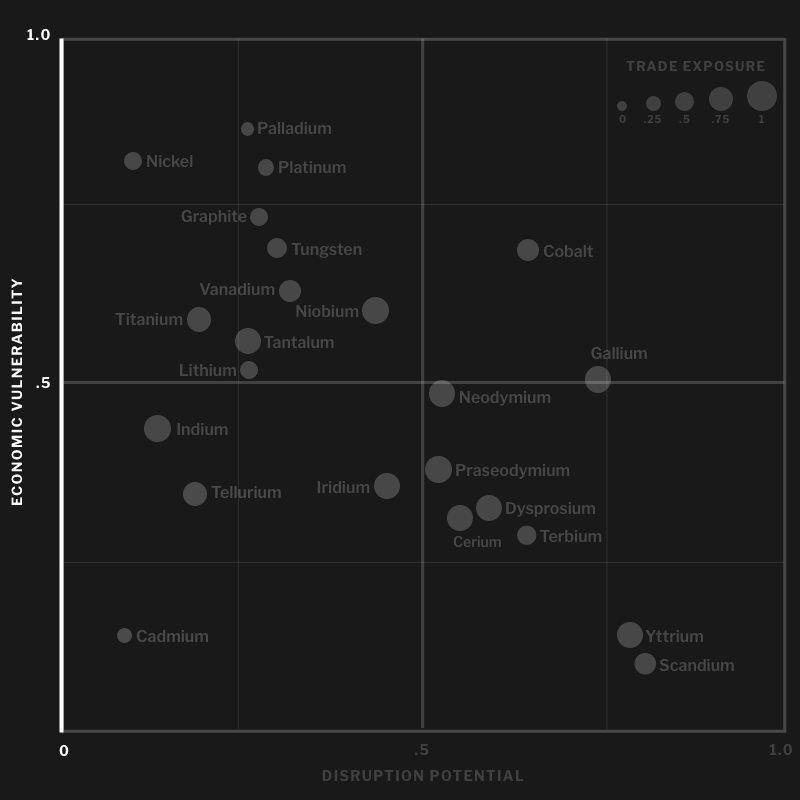

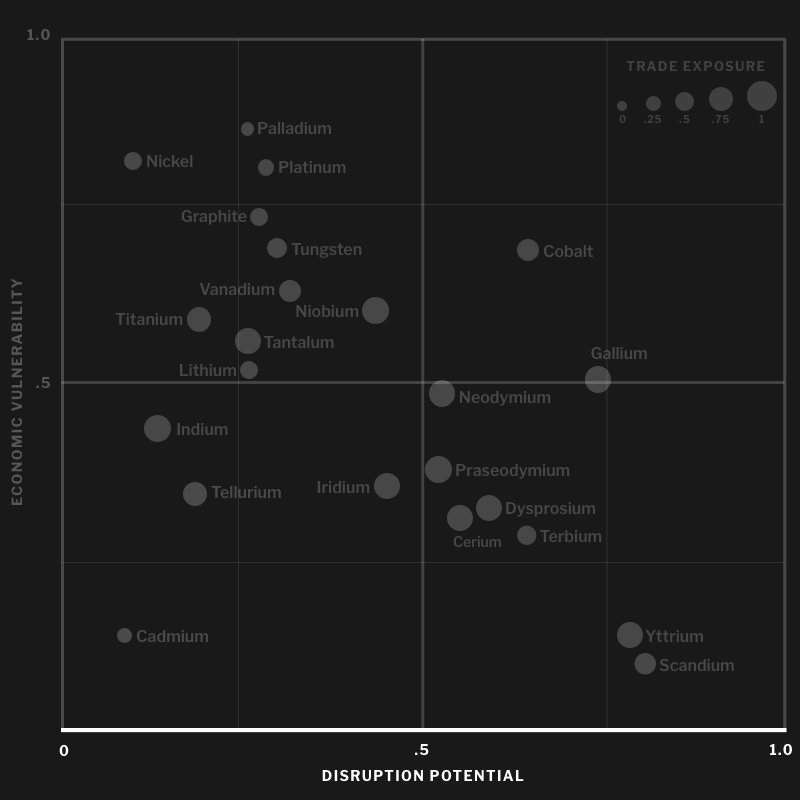

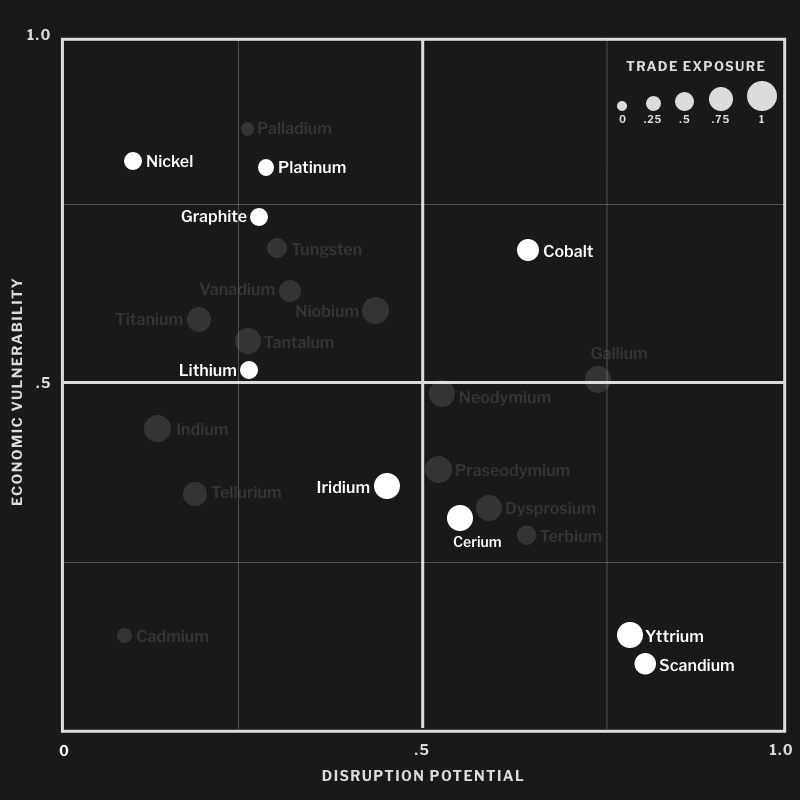

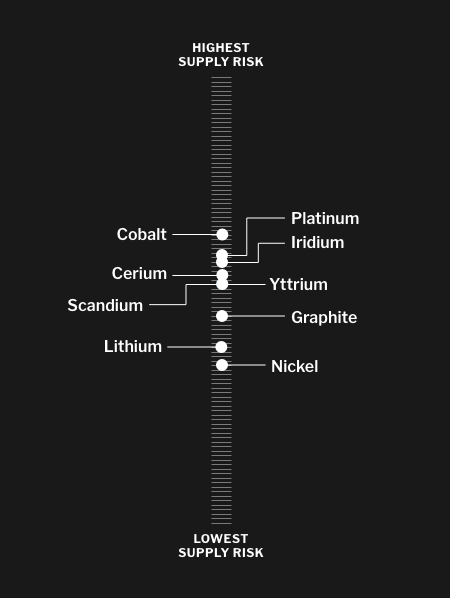

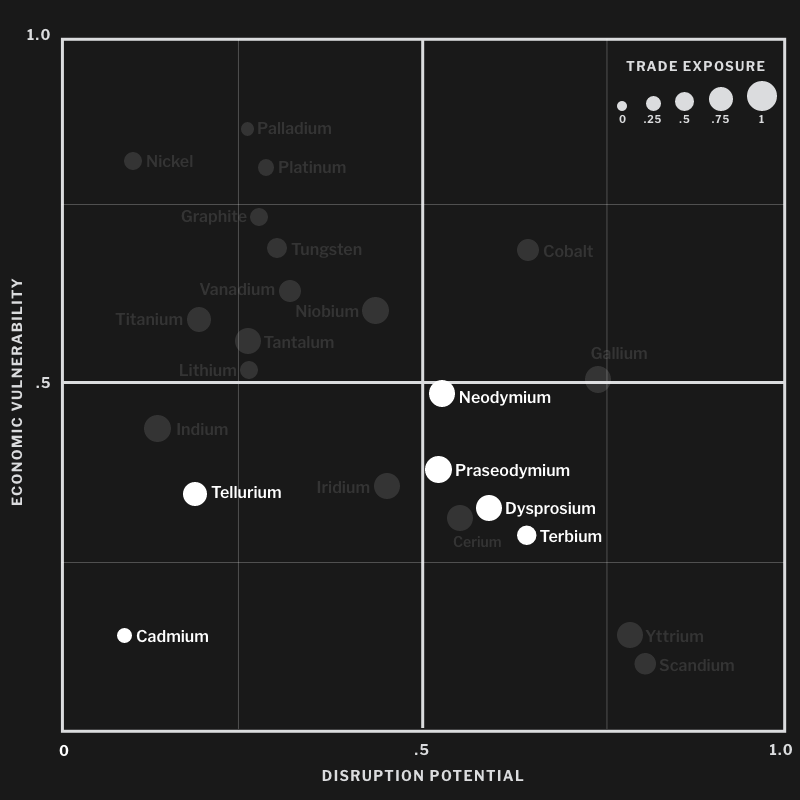

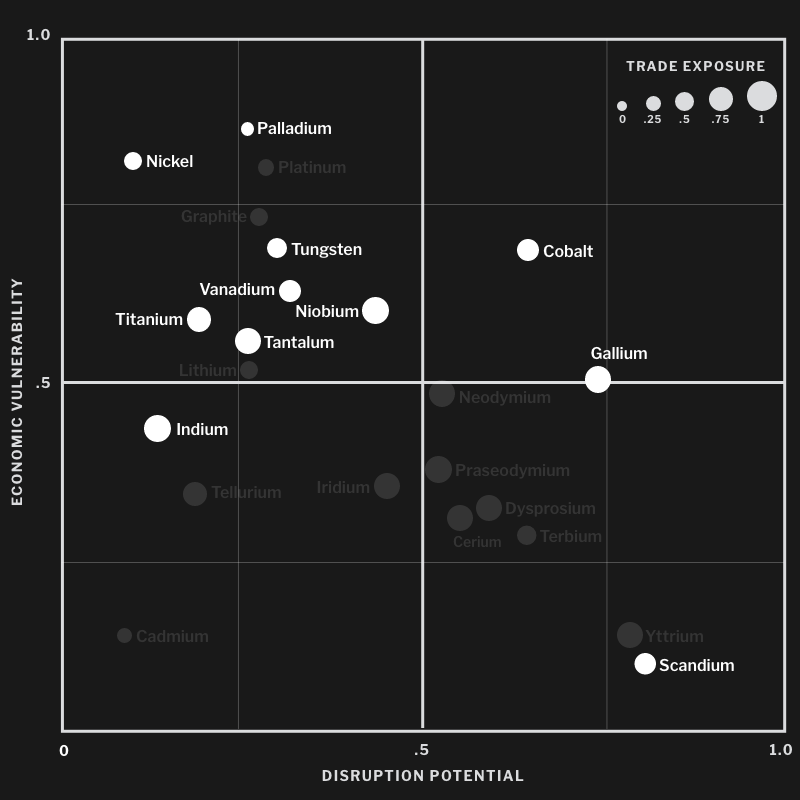

Washington’s clean energy, transportation, aerospace, and defense sectors are among the most dynamic areas of the state’s economy, but they also depend on secure supplies of over a dozen critical minerals. The USGS identifies these minerals and ranks their overall risk using a combination of metrics including trade exposure, economic vulnerability, and disruption potential:

DATA SOURCES: USGS, IEA, WORLD BANK, INTERNATIONAL JOURNAL OF ENERGY RESEARCH

Trade exposure, based on the level of import dependence. Larger circles indicate a greater share of US supplies from overseas.

Economic vulnerability, based on the value these minerals create in the economy. Minerals plotted higher on the Y axis are used in products accounting for a greater share of GDP than lower minerals.

Disruption potential, or the risk that countries with disproportionate control of these supply chains could cut off U.S. supplies. Minerals farther to the right on the Y axis are more concentrated in suppliers with the potential for trade conflict with the US.

Transportation

The lithium-ion batteries used in electric vehicles rely on cobalt, graphite, lithium, and nickel, whose midstream processing (and mining in the case of graphite) is dominated by China. Hydrogen transportation requires critical minerals for the production of electrolyzers as well as fuel cells, with a particular dependence on platinum and iridium mined primarily in South Africa.

Renewable and Zero-Carbon Electricity

Advanced wind turbines depend on permanent magnets using rare earth elements, with both production and processing highly concentrated in China. Electric and hydrogen-powered vehicles also depend on these magnets in their motors, making them important in multiple sectors. Uranium is no longer ranked by USGS due to a definitional change, but it is essential for nuclear power and significantly influenced by Russia throughout the supply chain.

Aerospace and Defense

The aerospace and defense sectors are dependent on advanced semiconductors, which typically use several critical minerals including gallium, a particularly high-risk mineral produced primarily in China. The superalloys used in jet engines require a wide variety of critical minerals, including niobium, cobalt, and other minerals with significant Chinese influence over major suppliers.

Unfortunately, there are a host of factors impacting these supply chains, which will need to quadruple by 2040 to meet the goals of the Paris Agreement. The issue is further compounded by concerns over supply chain security, due to players like China and Russia consolidating control over key critical minerals, as well as environmental, human rights, and geopolitical risks surrounding mining operations in countries where supplies are sourced.

Given the importance of these materials and the years-long process of establishing new mines and processing facilities, companies in sectors that are dependent on critical minerals need to be aware of these risks and pursue strategies to reduce their exposure in the near term. Mapping and understanding the suppliers, trade relationships, dependencies pertaining to specific inputs is an important first step. Recent efforts by the U.S. and its allies to secure and “nearshore” critical minerals industries, as well as foster related technological innovation in the development of more earth-abundant substitutes, could help mitigate some supply chain risks over the medium-to-long term, depending on how recently passed legislation is implemented and the rate and degree to which necessary investments are made.

JCDREAM was formed to accelerate the development of next-generation clean energy and transportation technologies in Washington State. One part of the organization’s strategic mission is to increase awareness of critical minerals supply chains risks and their ramifications for Washington’s leading companies.

FP Analytics, the research and advisory division of Foreign Policy, produced this report to highlight the specific ways that key sectors of the Washington state economy are dependent on critical minerals supply chains, while also revealing opportunities for the state to lead the way in mitigating risks and diversifying suppliers of the vital inputs that state industries depend on. In doing so, Washington State stands to fortify its industrial base and strengthen competitiveness across its clean energy and advanced technology sectors.

Critical Minerals Vital to Washington and Risks to Current Supplies

Critical minerals supply chains are global, complex, and often characterized by opaque bilateral trade arrangements with limited publicly available information. Understanding the geographic concentration of mineral deposits, the entities responsible for processing, and the ways in which the minerals are traded will be vital for the state to remain competitive and continue to lead in a range of advanced technology sectors. By identifying potential chokepoints and vulnerabilities for transportation, zero-carbon electricity, and aerospace and defense, leaders of local industries can refine strategies for input diversification and strengthen supply chain resilience. Considerations for sectors that are core to Washington State’s economy are discussed below:

Transportation

Transportation and energy are the lifeblood of Washington’s economy, with transportation and utilities directly accounting for over $20 billion in economic output and providing the electricity, gas, trucking, passenger transportation, and other services that virtually every industry in the state relies upon.

Washington is at the forefront of modernizing these sectors, having mandated in 2020 that the state reduce overall greenhouse emissions by 45 percent by 2030 and reach net zero by 2050. The state has also adopted California’s Zero Emission Vehicle (ZEV) rule, which will require a growing percentage of light- and medium-duty cars and trucks sold in the state to be electric or hydrogen-fueled starting in 2025, reaching 100 percent ZEVs by 2035.

The zero-carbon electricity sources and zero-emission vehicles that are required to meet these targets have the potential to reduce emissions and costs, while also providing market opportunities for innovative Washington-based companies in these sectors. Clean technology companies currently employ approximately 90,000 scientists, engineers, and researchers in Washington, and startups in areas such as battery materials, e-mobility, renewable energy software, and nuclear fusion are backed by over $200 million in venture capital and could increase the state’s cleantech workforce substantially in the years ahead. However, securing critical minerals supplies is vital to achieving these ambitious goals.

Lithium-Ion Batteries

Supply chain risks for EV batteries: China produces 75% of the world’s batteries, while the U.S. produces just 6%, with China maintaining control and influence of the EV value chain.

Click each mineral for more

DATA SOURCES: USGS, IEA, WORLD BANK

Electric vehicles are expected to account for the overwhelming majority of light-duty ZEVs, but supply chains for the lithium-ion batteries that power them include notable risks. Globally, BloombergNEF projects passenger EVs on the road to grow from 20 million today to over 700 million by 2040.

With China currently controlling or influencing over 75 percent of the world’s battery manufacturing, EV production will depend heavily on China’s battery output, absent significant acceleration of battery manufacturing hubs elsewhere around the world. Therefore, access to low-cost, plentiful lithium-ion batteries will be essential for the electric vehicles that Washington will depend on to meet its climate goals, as well as the success of in-state e-bike, e-boat, and other electric transportation startups.

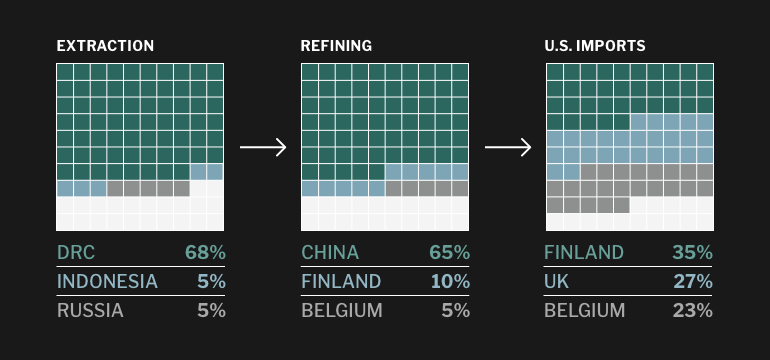

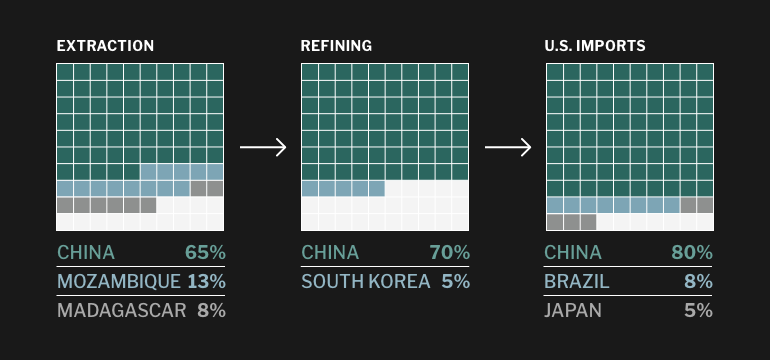

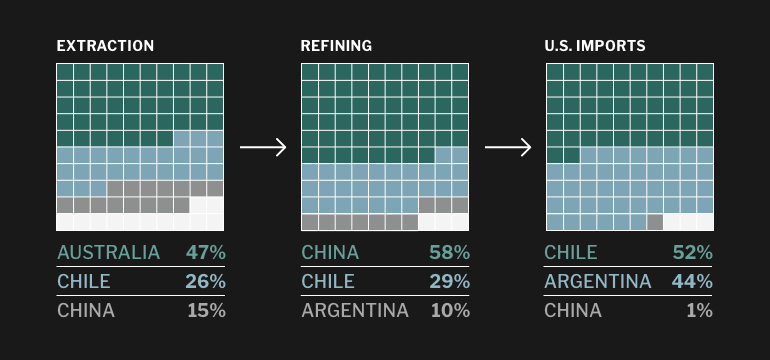

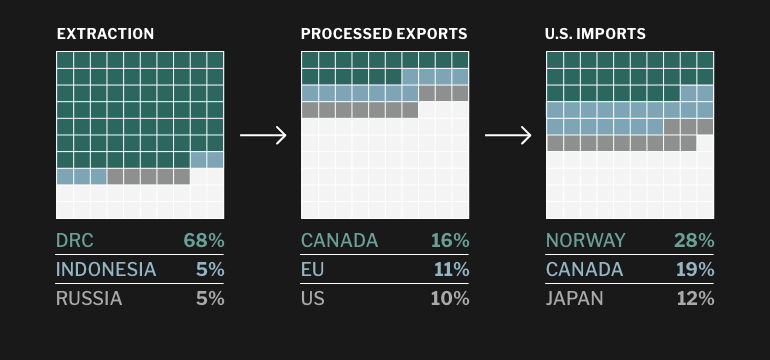

However, China has invested heavily in countries where these minerals are concentrated, including lithium extraction in Chile and Argentina, cobalt in the Democratic Republic of Congo (DRC), and nickel in Indonesia. Chinese companies also dominate the midstream processing that is necessary to convert all of these minerals into the refined products required for battery manufacturing, including a 65 percent share of cobalt processing, 58 percent of lithium processing, and 35 percent of nickel processing. The United States Geological Survey (USGS) considers the cobalt supply chain to be at particularly high risk, ranking third overall in its analysis, owing to the concentration of nearly 70 percent of production in DRC, often in artisanal mines that, in some cases, have been connected with child labor and human rights abuses,[1] and China’s control over processing. In addition, China produces over 65 percent of the world’s natural graphite, and it processes almost all of the spherical graphite required in battery anodes, further concentrating that country’s and its enterprises’ influence in the sector.

In order to reduce the dependence of EVs on cobalt in particular, a growing number of manufacturers are beginning to use batteries with an older lithium-ion chemistry, known as iron phosphate or LFP. By replacing expensive cobalt as well as nickel in the battery cathode with earth-abundant iron phosphate, LFP batteries lose energy density compared to the dominant nickel manganese cobalt (NMC) batteries – a major concern for vehicles seeking to maximize range – but they also offer the ability to reduce costs by around 20% by cutting reliance on critical minerals and avoids the human rights risks of cobalt production. According to BloombergNEF, these advantages have boosted LFP’s market share for EV batteries from less than 10% in 2018 to nearly 40% in 2022. At the same time, LFP batteries still depend on lithium and graphite supply chains, and China is even more dominant in LFP battery manufacturing with a 95% market share. Tesla has partnered with Chinese battery giant CATL to provide LFP batteries for its shorter-range vehicles, including those sold in China, and Ford recently announced plans to partner with CATL to build LFP manufacturing capacity in the US.

Finally, as discussed below in the section on clean electricity, China also produces an overwhelming share of the rare earth elements used in permanent magnets, which are required for the most advanced types of wind turbines as well as the motors that propel electric and hydrogen-fueled vehicles.

Hydrogen

Supply chain risks for PEM electrolyzers and fuel cells: U.S. firms have 60% of the world’s PEM electrolyzer manufacturing capacity but are dependent on platinum, and iridium catalyst supply chains are heavily dependent on production in South Africa.

Click each mineral for more

DATA SOURCES: USGS, IEA, WORLD BANK

While battery supply chain risks are most relevant to the electrification of the light-duty passenger fleet, the relatively low energy density of batteries and their resulting weight represents a challenge for heavy-duty trucking and aviation applications. As a result, some firms in these industries are looking instead to hydrogen, as well as to synthetic “e-fuels” derived from hydrogen, which—in addition to offering much greater energy density than batteries—can be produced with zero emissions through clean electricity-powered electrolysis and offers much greater energy density than batteries. As discussed below in the energy storage section, hydrogen may also offer a promising medium for long-duration grid storage, with hydrogen produced during times of excess wind and solar generation and used for power generation at times of peak demand.

The manufacturing of proton exchange membrane (PEM) electrolyzers, which is considered key for producing zero-carbon green hydrogen from renewables, is one area where U.S. and European manufacturers are leading the way, with U.S. firms accounting for 60 percent of global PEM production, and Europe and the UK accounting for another third.

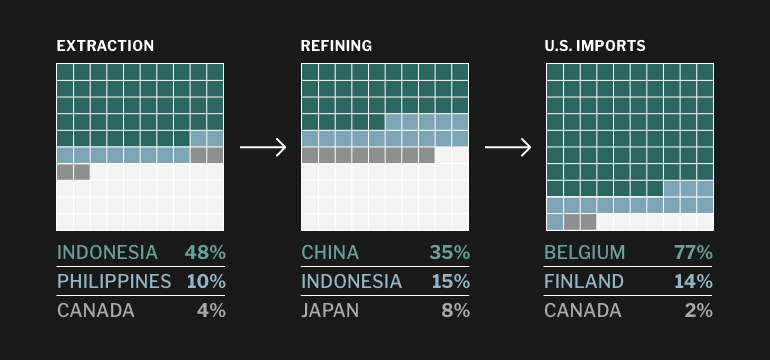

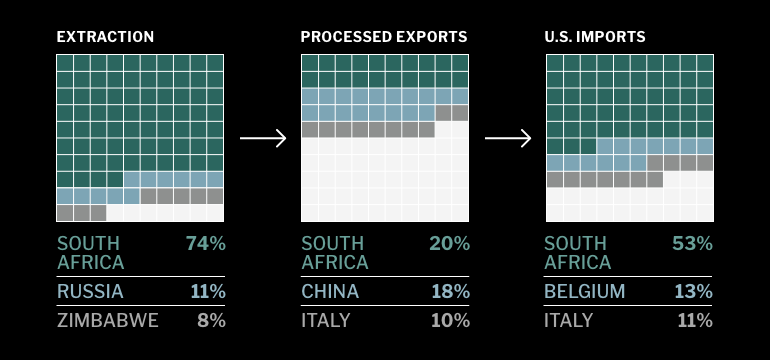

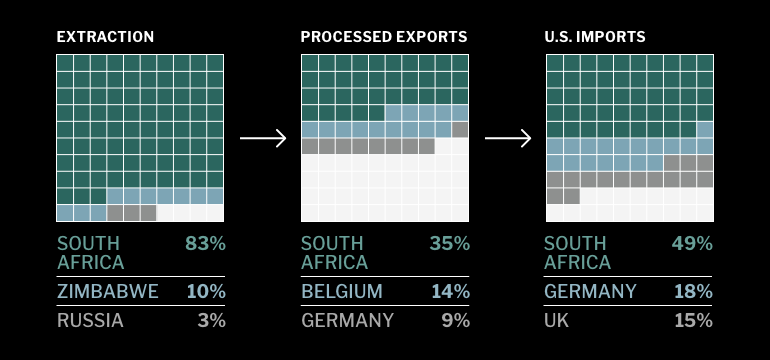

These domestic manufacturing supply chains are heavily dependent on critical minerals imports, however, particularly for platinum and iridium catalysts. Production of these and other platinum group metals (PGMs) are heavily concentrated in South Africa, with a 74 percent share of platinum production and a similar share of PGM processing. A deepening electricity crisis in South Africa is threatening the reliability of these supplies, however, with increasingly frequent blackouts on the fragile state-owned grid resulting in a drop in platinum production by an estimated 6 percent last year, and deeper cuts are expected in the years ahead. Iridium supply sufficiency is a particular source of concern for hydrogen, as this rarer PGM is produced only in small quantities as a byproduct of platinum and palladium mining and imported almost entirely from South Africa.

The (distant) second- and third-largest producers of platinum are Russia at 11 percent of the global total, and Zimbabwe with 8 percent, and each poses clear political risks. Moreover, China secured a large share of Zimbabwe’s platinum resources decades ago as collateral for loans to that country, and it has plans to invest in new processing for platinum and other metals.

To minimize exposure to rising platinum and iridium risks, Washington-based hydrogen developers may consider non-PEM electrolyzer technologies, but the two main alternatives—alkaline electrolyzers and solid oxide electrolyzers (SOE)—also come with their own supply chain risks and operational tradeoffs.

Alkaline electrolyzers are a mature, relatively low-cost technology, but drawbacks include poor performance when ramping up and down. This is a key potential concern for hydrogen developers wishing to take advantage of incentives for green hydrogen production. Their supply chains are also dominated by China, which is home to 66 percent of global alkaline electrolyzer production capacity, as well as a majority of the nickel and graphite supplies used in their manufacture. Solid oxide electrolyzers (SOEs) have particular appeal for nuclear power-fed electrolysis, since they can utilize waste heat from a plant to achieve higher operating temperatures and efficiencies than PEM, and manufacturing is primarily based in the U.S., Japan, and Europe. However, SOEs are a much-less-proven technology, with higher costs and low durability to date, and their manufacture requires the rare earth elements scandium and yttrium, which, like the other rare earth elements, are typically imported from China.

Renewable & Zero-Carbon Electricity

As part of its overarching climate goals, Washington has also passed a mandate requiring the state’s investor-owned utilities to generate 100 percent of their electricity from renewable or zero-carbon sources (e.g., nuclear) by 2045.

The state already has a considerable head start, with its abundant hydropower resources supplying 64 percent of the state’s electricity mix, and wind and nuclear power plants providing an additional 8 percent each. While these combined renewable sources contribute to Washington having one of the lowest-emission grids in the country, clean energy generation expansion is needed to not only replace the nearly 20 percent of electricity still powered by fossil fuels, but also meet increasing demand from the electrification of transportation and production of hydrogen.

This expansion will be particularly vital to boost hydrogen opportunities in the state, as forthcoming rules for new U.S. tax credits for green hydrogen may include “additionality” requirements for electrolyzers to be powered by dedicated new clean electricity sources instead of cannibalizing existing production. Looking to the future, there may be limited opportunities to expand hydropower generation, particularly as existing facilities come under scrutiny for their environmental impacts. Further, with well-documented political and economic obstacles to expanding conventional nuclear power, the two main opportunities to grow clean electricity supplies in Washington State are likely to be wind and advanced nuclear power, with solar representing a small but growing fraction.

Wind Power

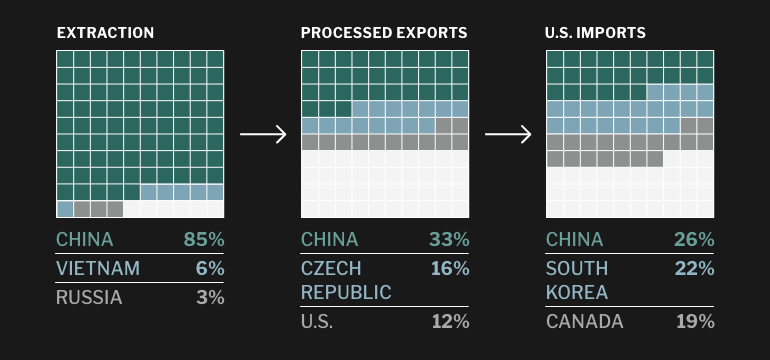

Supply chain risks for wind turbines: China dominates the production of rare earths for permanent magnets used in advanced direct drive wind turbines, and manufactures 58% of the world’s wind turbines overall.

DATA SOURCES: USGS, IEA, WORLD NUCLEAR, EIA

Wind power surpassed nuclear in 2021 to become the largest non-hydro source of renewable energy in Washington, and it offers the greatest opportunity for near-term development due to fast construction times and ample available resources.

Two major developments in Washington State include the advent of floating offshore wind farms and direct drive wind turbines. Floating offshore windfarms have led in-state developers to propose projects off the steeply sloping Washington coast for the first time, and direct drive wind turbines offer advantages in efficiency and maintenance, compared to traditional geared turbines and are considered particularly important for offshore wind development.

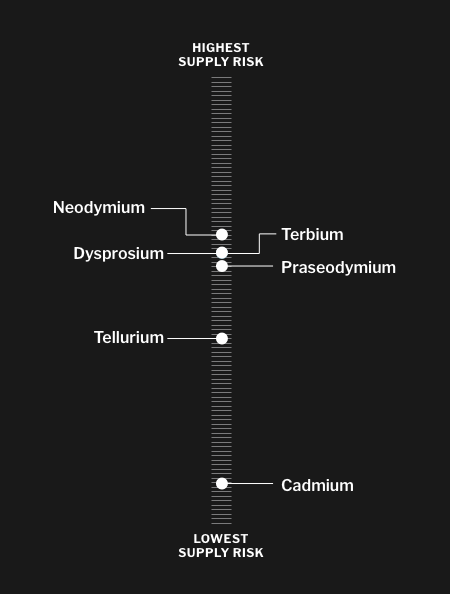

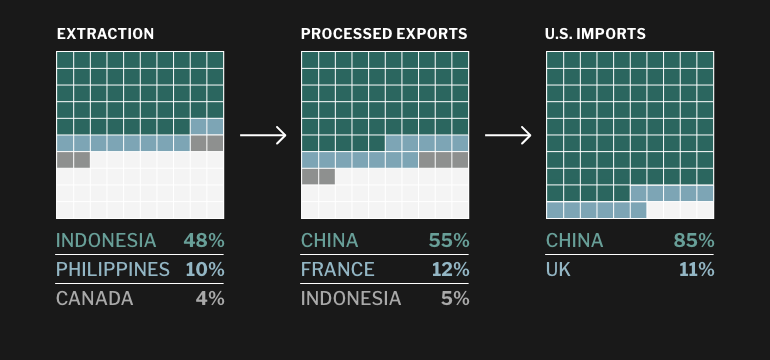

Direct drive wind turbines rely on high-performance neodymium-iron-boron (NdFeB) magnets, which contain the rare earth elements (REEs) neodymium, praseodymium, dysprosium, and terbium. These materials are in high demand as they are also used in the electric motors that power EVs and hydrogen-fueled vehicles.

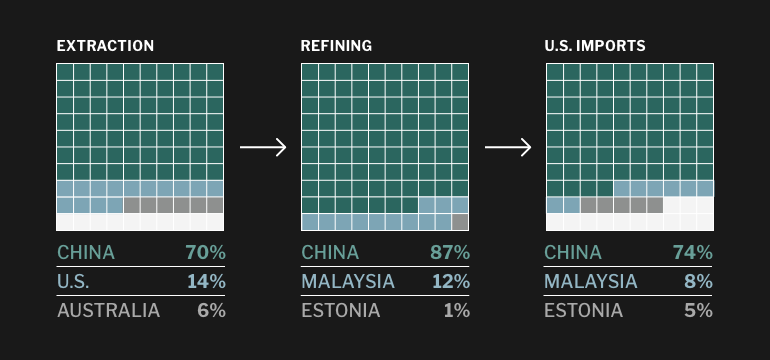

Unsurprisingly, the REE supply chain, including both production and processing, is almost completely dominated by China. In fact, in addition to being home to a 70 percent share of global production, China controls 87 percent of rare earth processing and 92 percent of rare earth magnet production, giving it a near-monopoly over the value chain for these essential components, and it has weaponized its control over rare earths before. As a result of this supply concentration and disruption risk, the USGS lists neodymium as the fourth-riskiest U.S. critical minerals supply chain, with praseodymium close behind.

Wind power surpassed nuclear in 2021 to become the largest non-hydro source of renewable energy in Washington, and it offers the greatest opportunity for near-term development due to fast construction times and ample available resources.

Two major developments in Washington State include the advent of floating offshore wind farms and direct drive wind turbines. Floating offshore windfarms have led in-state developers to propose projects off the steeply sloping Washington coast for the first time, and direct drive wind turbines offer advantages in efficiency and maintenance, compared to traditional geared turbines and are considered particularly important for offshore wind development.

Direct drive wind turbines rely on high-performance neodymium-iron-boron (NdFeB) magnets, which contain the rare earth elements (REEs) neodymium, praseodymium, dysprosium, and terbium. These materials are in high demand as they are also used in the electric motors that power EVs and hydrogen-fueled vehicles.

Unsurprisingly, the REE supply chain, including both production and processing, is almost completely dominated by China. In fact, in addition to being home to a 70 percent share of global production, China controls 87 percent of rare earth processing and 92 percent of rare earth magnet production, giving it a near-monopoly over the value chain for these essential components, and it has weaponized its control over rare earths before. As a result of this supply concentration and disruption risk, the USGS lists neodymium as the fourth-riskiest U.S. critical minerals supply chain, with praseodymium close behind.

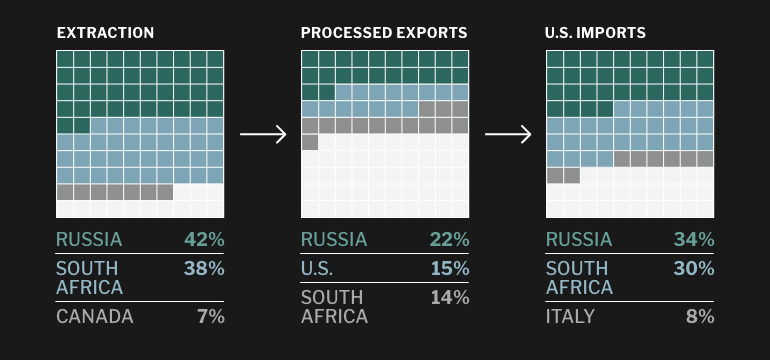

Nuclear Power

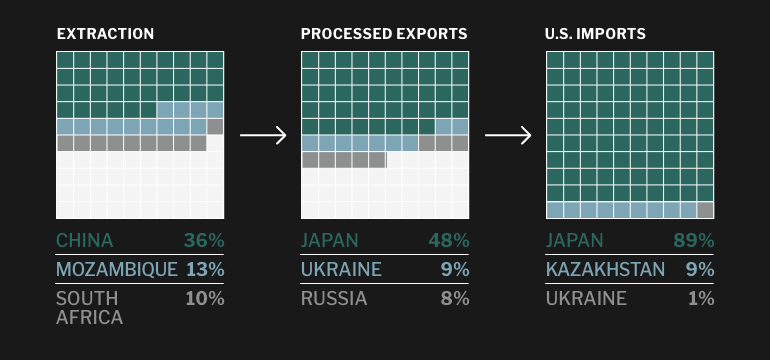

Supply chain risks for nuclear power: Russia is a key global player in uranium processing and enrichment services, leaving U.S. projects subject to geopolitical and supply chain risks.

DATA SOURCES: USGS, IEA, WORLD NUCLEAR, EIA

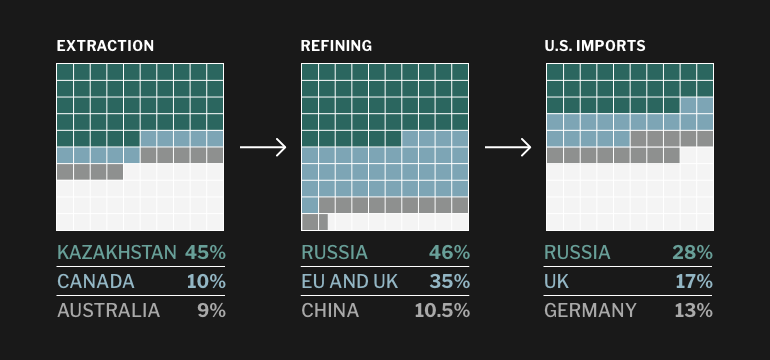

Nuclear power remains the second-largest source of non-hydro zero-carbon power on Washington’s grid by far. For this analysis, uranium is recognized as a critical mineral, although it was dropped from the USGS Critical Minerals list in 2022 due to a change in definition that excludes “fuel minerals.”

Russia’s invasion of Ukraine has provided a stark example of the risks that critical minerals supply chain dependence can pose to clean electricity, particularly in the emerging advanced nuclear sector. While Russia produces only 8 percent of the world’s uranium, it operates over 40 percent of both the uranium conversion and enrichment capacity required to turn raw uranium into fuel. The U.S. currently imports over a quarter of its enriched uranium from Russia, and in contrast to fossil fuels, due to this dependence, it has not sanctioned Russia’s uranium exports amid the ongoing invasion of Ukraine.

Even more challenging, Russia is home to the only facility in the world that sells a form of uranium fuel called high-assay low-enriched uranium (HALEU). This fuel, which is enriched to a higher level than the uranium used in typical reactors but a lower level than used in nuclear weapons, is required for most advanced nuclear small modular reactor (SMR) designs, which aim to replace the traditional paradigm of bespoke, on-site assembly of gigawatt-scale nuclear plants with much smaller plants that are mass-produced in a factory. A lack of secure supplies for HALEU is an existential threat to many SMR startups, including a pair of companies with ties to Washington.

Solar Power

Supply chain risks for solar: Conventional silicon solar cell supply chains are highly dependent on polysilicon from China, but no critical minerals. By contrast, thin-film solar panels require cadmium and tellurium, critical minerals with a major but less-dominant position for China.

Click each mineral for more

DATA SOURCES: USGS, IEA, WORLD BANK

Solar power currently provides a small portion of Washington’s electricity mix, accounting for less than 0.05 percent of the overall state generation. While the region’s poor solar resource availability will almost certainly limit opportunities to scale up this sector, a growing number of solar projects are being proposed in the eastern portion of the state, which tends to receive more sunshine than elsewhere in Washington.

In light of the fact that solar cells are manufactured with abundant raw materials, critical minerals are not expected to be a major barrier to efforts to revive U.S. solar manufacturing. However, other risks associated with solar photovoltaic (PV) supply chains have become a growing focus. The majority of solar installations in the U.S. use crystalline silicon cells imported from China, which may use polysilicon produced in Xinjiang, where forced labor has been documented, leading to a growing crackdown by the U.S. on Chinese imports. Crystalline silicon-based solar provides an alternative to thin-film solar panels, and the U.S. is home to long-time industry leader First Solar. This solar technology accounts for 16 percent of the U.S. solar market and offers lower capital costs but is also less efficient at converting solar energy to electricity. And while thin-film solar offers a robust U.S. manufacturing base, its production requires cadmium and tellurium, which are primarily produced in China.

Energy Storage

When wind and solar resources aren’t available, the gap is currently filled by natural gas peaker plants, which ramp up and down more quickly than hydro or nuclear plants. Eliminating this fossil fuel fraction of the electricity mix is a priority for meeting utility decarbonization mandates and for numerous constituents. They include grid-tied green hydrogen producers who wish to minimize their lifecycle emissions, and companies prioritizing the purchase of 100 percent clean electricity, like Google, Microsoft, and Amazon, who have all made this a goal for their data center operations, including locations in Washington, in benefit from a relatively low-cost, hydropower-dominated grid.

Energy storage allows for excess zero-carbon generation to be “saved” for delivery during demand peaks, instead of using fossil fuels. Because development of new hydropower capacity is limited, and advanced nuclear plants are unlikely to come online until the end of the decade, energy storage is a key resource for squeezing fossil fuels out of the region’s grids.

Varying energy storage technologies offer different combinations of cost, storage duration, and supply chain risks, however. The same types of lithium-ion batteries used in EVs can be aggregated into large, grid-scale storage facilities. Large-scale battery facilities are often the lowest-cost solution for managing generation on a daily basis, but they have a limited duration of roughly four hours and may be insufficient for weeks of low wind or for winter months of lower solar availability. Vanadium redox flow batteries offer storage durations of up to 10 hours and greater durability at potentially similar costs, but they are similarly limited in their ability to store power cost-effectively over weeks or months and, they require vanadium, a critical mineral mined primarily in China and Russia.

For long-duration energy storage (LDES) applications, non-battery technologies offer alternatives. The largest source of grid storage globally, and in Washington, is pumped hydro storage, which uses electricity to pump water from the lower reservoir of an existing hydropower dam to the upper reservoir, where it can be used for generation at a later time. This extremely cost-effective (and non-critical mineral-dependent) form of LDES is considered to have limited opportunities to expand due to the site-specific nature of hydropower dams. However, a new paradigm of “closed loop” pumped hydro storage is emerging that aims to create new, damless reservoirs with no connection to existing rivers. One of the first projects demonstrating this technology is being developed in neighboring Oregon, where Rye Development is aiming to build a 400 MW storage facility.

Another LDES application that is relevant to Washington could be the use of hydrogen itself as a storage medium, if excess wind and solar are used to produce green hydrogen. Green hydrogen can be stored much like natural gas and used to produce power when needed with fuel cells or modified gas turbines. This hydrogen application is likely to be a more expensive storage option than conventional pumped hydro, but offers much greater flexibility in siting and scale. The advantages and disadvantages of each application are also tied to the how long the energy can be stored. For a deeper discussion on cost and storage tradeoffs, see Part 2 of this analysis.

Aerospace and Defense

Washington’s world-leading aerospace and defense sector includes over 1,300 companies, ranging from industry leaders like Boeing and Lockheed Martin to a wide variety of supply chain providers. This $70 billion industry supports more than 250,000 jobs statewide, making it one of the most important single sectors of the state economy. More broadly, in contrast to batteries and other clean energy and transportation technologies, the U.S. is the global leader in aerospace and defense manufacturing. However, domestic manufacturers’ supply chains are also vulnerable to critical minerals disruptions for some of their most vital components, making supply chain security both an economic and national security imperative.

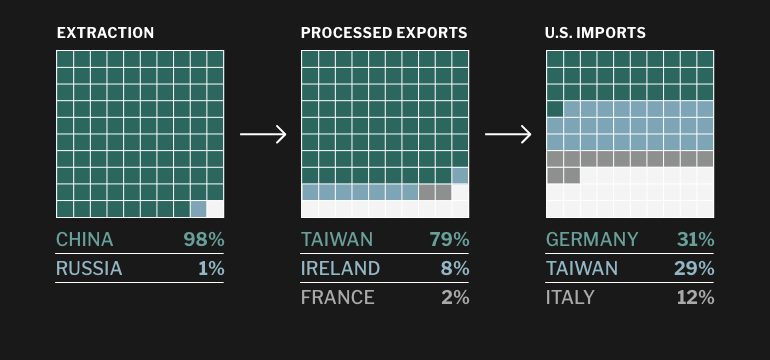

Semiconductors

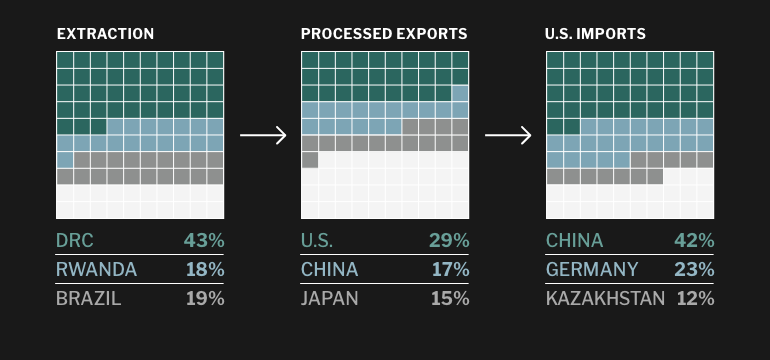

Supply chain risks for semiconductors: The advanced semiconductors used in aerospace and defense applications are primarily manufactured in Taiwan, but they depend on gallium produced overwhelmingly in China, along with other minerals that are often sourced from China, Russia, and DRC.

Click each mineral for more

DATA SOURCES: USGS, WORLD BANK, US-TAIWAN.ORG, STATISTA

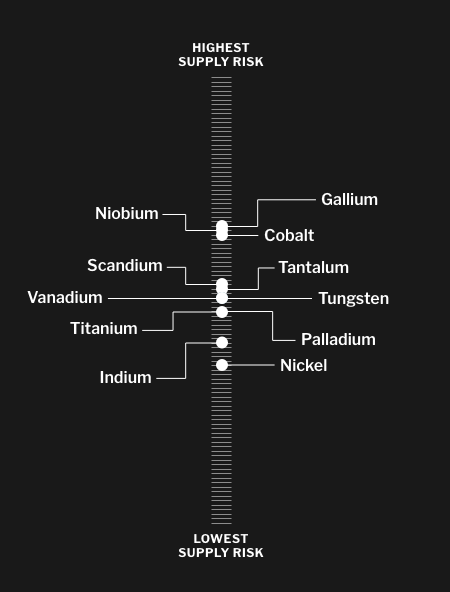

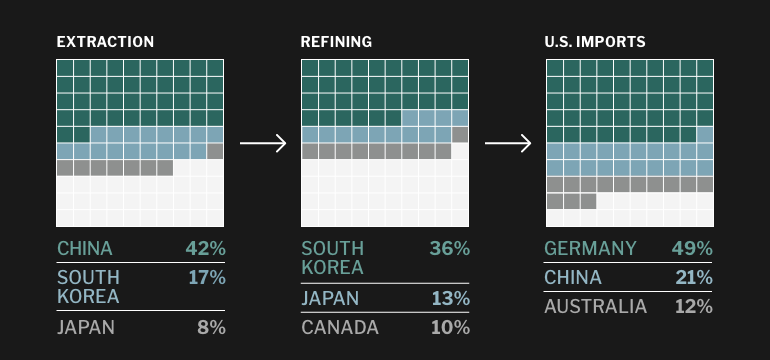

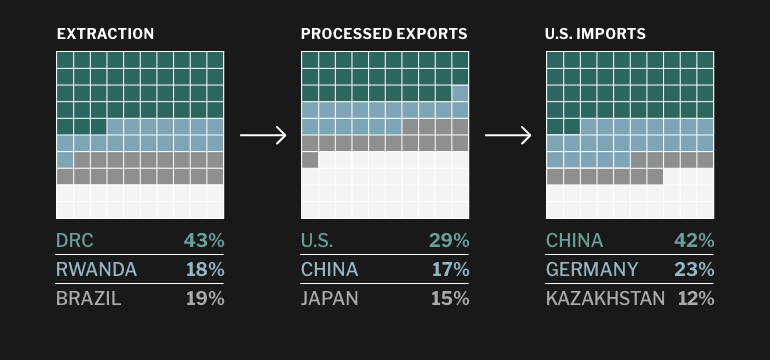

For decades, the Pentagon and defense industry have been focused on supply chains for semiconductors, particularly the high-frequency wide bandgap (WBG) gallium arsenide (GaAs) and gallium nitride (GaN) semiconductors that power aircraft navigation and communication systems, targeting systems, and other advanced defense and aerospace industry applications. While these aerospace- and military-grade semiconductors are typically designed by U.S. firms and manufactured domestically or in Taiwan, their production requires a variety of critical minerals, including gallium, tantalum, palladium, and indium, all of which carry significant supply chain risks.

China wields considerable influence over semiconductor production from a critical minerals supply chain standpoint. It produces 98 percent of the world’s crude gallium, which is ranked as having the highest supply chain risk of all the critical minerals by USGS. While the vast majority of the gallium originates in China, the imposition of tariffs on a wide range of imports from China in 2018 has led the U.S. to shift its supply chains for gallium arsenide wafers, sourcing half of these intermediate components from Europe and more than a quarter of them from Taiwan.

China is also the leading producer of indium and represents 42 percent of U.S. refined tantalum powder imports. However, other semiconductor minerals also need to be sourced internationally, including palladium from Russia and South Africa, and tantalum from the DRC and Rwanda. While the U.S. and other governments are supporting the localization and regionalization of semiconductor manufacturing facilities, producers will still be exposed to supply risks with these key inputs.

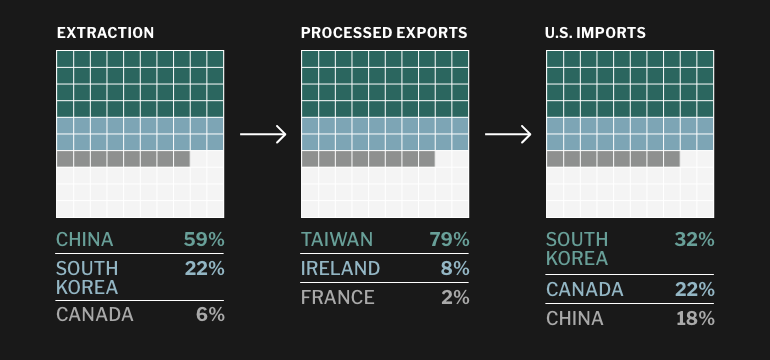

Jet Engines

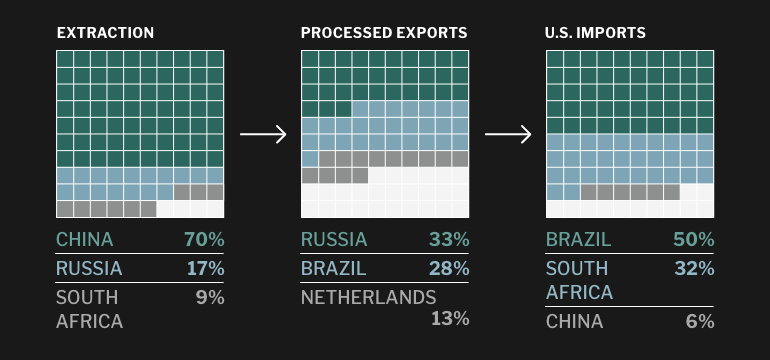

Supply chain risks for jet engines: The U.S. represents 46% of the global market for aerospace/defense industries. Jet engines produced by the U.S. aerospace sector require superalloys dependent on a wide variety of minerals, many of which have risks from high supplier concentration, Chinese ownership and influence over supply chains, or both.

Click each mineral for more

DATA SOURCES: USGS, WORLD BANK, US-TAIWAN.ORG, STATISTA

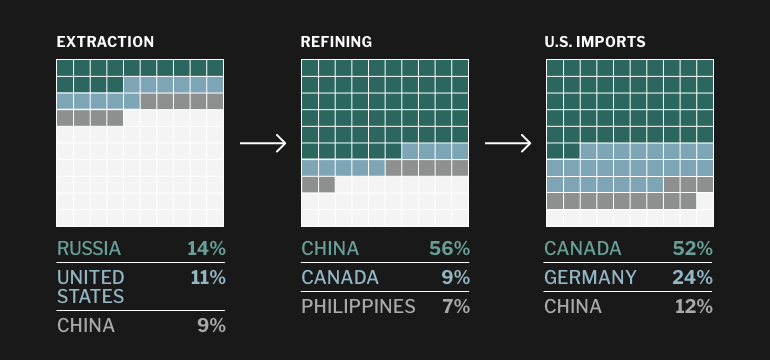

Jet engines represent another core component for Washington’s aerospace and defense manufacturing companies. Their critical minerals supply chain vulnerabilities include a reliance on NdFeB magnets, which feature REEs, as well as a number of critical minerals that are essential for the super alloys used in jet engine manufacturing.

The REEs used in the NdFeB magnets required by jet engines are considered “heavy” REEs and are typically found in much lower concentrations of rare earth ores, which require costly additional steps to separate and process. China, thanks in part to imports of heavy REE-rich ionic clays from Myanmar, effectively controls 100 percent of the production of these elements, constituting a particular risk to the U.S. defense industry.

Furthermore, jet engine manufacturing requires almost a dozen critical minerals, with vanadium and titanium used for alloys in composite airframe and other aircraft components, and dysprosium and terbium blanketing REE magnets to protect against high temperatures in engines.

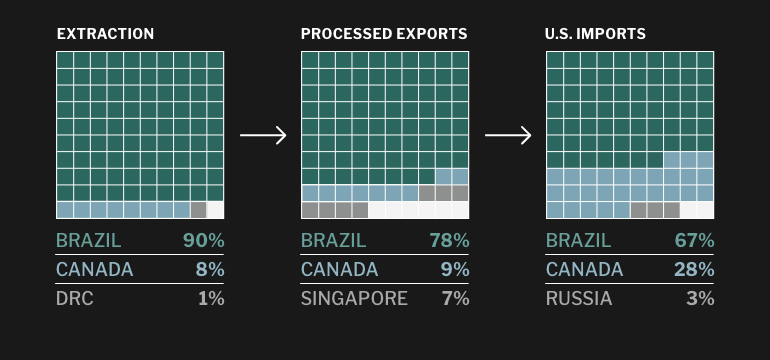

With a lengthy list of critical minerals required, the supply chain risks for jet engines are far reaching, with imports required from Brazil, Central Africa, China, Russia, South Africa, and elsewhere. Major concerns include access to niobium, which the USGS assigned as having the second-highest overall supply chain risk due to Brazil’s production and refinery dominance and Chinese firms owning 50 percent of its two largest niobium mines.

Seeking Supply Chain Security Through Reshoring and “Friendshoring”

Historically, U.S. companies led the way in the discovery, mining, and processing of many critical minerals. Since the 1980s, however, the domestic mining sector has declined due to competition from lower-cost production overseas, most notably a decades-long strategy by China to subsidize and build-up its own domestic champions with holdings in key producing countries. Domestic development has also been challenged by environmental and regulatory frameworks as well as litigation in the U.S.

Recently, recognition of strategic supply chain vulnerabilities has prompted policymakers, defense departments, and businesses in the U.S. to increasingly focus attention on securing supply, either through reshoring domestic production or by “friendshoring” supplies from allied countries.

The Trump administration took steps toward recognizing this threat as part of its escalating trade conflicts with China, issuing executive orders requiring federal agencies to develop strategies to reduce vulnerabilities to critical minerals supply disruptions and explore the potential to use existing statutory authorities to increase resilience.

More recently, the Biden administration has followed through as part of its push for climate action and green jobs, leveraging existing federal funding and financing mechanisms to support domestic investments in mining, as well as midstream processing.

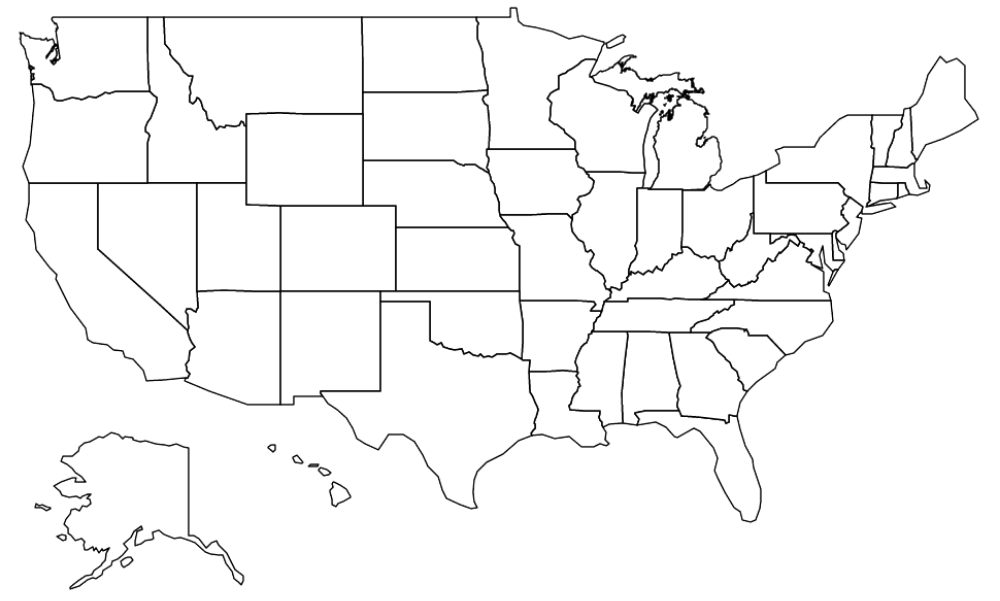

U.S. Reshoring Projects Under Development

Hover over each mineral’s symbol for more information

DATA SOURCES: DOE, DOD, GRIST, MOCOBALT, REUTERS, ELECTREK, NY TIMES, POLITICAL, MINE

Most consequentially, Congress recently passed three new pieces of major legislation, which represent the largest investments in U.S. critical minerals supply chains in a generation:

- Bipartisan Infrastructure Law (2021): The Bipartisan Infrastructure Law (BIL) provided over $6 billion in funding for battery supply chains, including support for battery material processing projects and battery manufacturing and recycling. It also contained important provisions for critical minerals, including $140 million toward rare earth element extraction and separation from mining waste feedstocks and $320 million for an Earth Resource Mapping Initiative that will identify U.S. critical minerals resources more comprehensively. Notably, Washington was included in this mapping initiative, with allocations toward assessing potential resources in the northeast area of the state.

- Inflation Reduction Act (2022): The momentum of BIL was supercharged by the Inflation Reduction Act (IRA), which delivered unprecedented support for the full clean energy value chain. Relevant provisions include extensions and expansions of tax credits for zero-carbon technologies and electric vehicles (EVs), plus a critical minerals supply push. Specifically, the bill requires EV manufacturers to phase out the sourcing of critical minerals and battery components from “foreign entities of concern” within the next three years. It also includes a 10 percent manufacturing credit that covers the mining and refining of critical minerals and a $500 million investment in critical minerals supply chains under the Defense Production Act (DPA).

- Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act (2022): The CHIPS and Science Act supports the semiconductor industry by delivering $52.7 billion in grants for domestic R&D, manufacturing, and workforce development. CHIPS also authorizes $10 billion for the development of regional innovation and technology hubs for semiconductor development, which—if the funds are eventually appropriated by Congress—would tie together state and local governments, educational institutions, businesses, and other partners toward domestic technology innovation and manufacturing.

It is important to note that the U.S. isn’t alone in acting on critical minerals. Other Free Trade Agreement (FTA) partners, including Australia, Canada, and Europe, are also providing their own support for these sectors by attempting to reduce China’s influence over their mining sectors and developing their own frameworks to build critical minerals resilience.

EU and UK

LITHIUM, RARE EARTHS POTENTIAL

- European Commission, France, Germany, Finland, UK partners in U.S. Mineral Security Partnership

- Sweden’s LKAB discovers Europe’s largest rare earth deposit

- UK developing two lithium mining and two lithium refining projects

- Finland and France developing Europe’s first lithium mines

The iron mine of Swedish state-owned mining company LKAB in Kiruna, Sweden. JONATHAN NACKSTRAND/AFP VIA GETTY IMAGES

Canada

COBALT, INDIUM, NICKEL, NIOBIUM, PGMS, VANADIUM

- Partners in U.S. Mineral Security Partnership, plus bilateral partnerships on critical minerals with U.S., EU, and Japan

- Australia’s Vital Metals opens Canada’s first rare earths mining and processing facility, supported by $5 million grant

- Critical minerals strategy will review and streamline permitting, invest $3 billion in 2023

- Canada has submitted projects to U.S. for DPA consideration; DOD considering direct investment in Ontario “Ring of Fire” region for nickel, copper, and lithium mining

The site of the Goro Nickel mining project in Noumea, Canada. MARC LE CHELARD/AFP VIA GETTY IMAGES

Australia

LITHIUM, REES, COBALT, TITANIUM, URANIUM, VANADIUM

- Partners in U.S. Mineral Security Partnership, plus bilateral partnerships on critical minerals with U.S., EU, and Japan

- Government financing for multiple domestic processing facilities for REE, lithium, and vanadium, as well as graphite and cobalt mining and processing

- Working with DOD, EXIM Bank, DFC to facilitate U.S. investments in Australian mining and processing

- Europe looking to include critical minerals in FTA negotiations

- Chinese and South Korean firms investing in lithium refining

A processing plant at a lithium mine in western Australia. iStock

Geopolitical Competition for Critical Minerals Supply Chains Intensifying

The new policies implemented over the last few years in the U.S. are a good start toward reorienting domestic supply chains. Unfortunately, they’re likely not enough when one considers the expected demand growth for critical minerals and the reality that new mining projects in the U.S. are likely to take a decade or more to develop, due to permitting and other development challenges. This inability to quickly reorient supply chains means a continued reliance on critical minerals supplies from overseas providers, predominantly in Africa, Latin America, and Asia-Pacific, as well as competing for access and facing harder bargains from these mineral-rich countries:

Global Resource Competition: Africa

Click on each for more information

The fiercest competition is playing out in Africa, where critical minerals reserves include cobalt and tantalum in the Democratic Republic of Congo (DRC), platinum and vanadium in South Africa, and more. Unsurprisingly, these mineral-rich countries are eager for foreign investments, but also concerned about the economic and environmental trade-offs.

The recent launch of the U.S.-led Mineral Security Partnership (MSP) is an effort by the U.S. and its allies to create a mutually beneficial framework that “supports countries in realizing the full economic development potential of their mineral resources,” while also promoting high standards throughout critical minerals supply chains.

Due to their expansive existing footprint and willingness to invest heavily in countries with high levels of political risk, China and its mining firms will likely continue to provide formidable competition in Africa. However, several countries in Africa are already showing their support for the MSP’s efforts to strengthen the critical minerals supply to the U.S. and its allies.

These positive developments include five African countries attending the MSP launch, with the DRC also reportedly pushing for renegotiations of cobalt mining agreements signed with Chinese firms. Additionally, the U.S. recently signed an MOU with the DRC and Zambia to develop value-added minerals processing and battery manufacturing projects. These efforts are also resulting in positive critical minerals supply chain developments for Washington State. KoBold Metals, a mineral exploration startup backed by Jeff Bezos and Bill Gates’ Washington-based Breakthrough Energy Ventures, has announced a $150 million investment in a copper-cobalt mining project in Zambia.

Global Resource Competition: Latin America

Click on each for more information

Latin America is another region in focus for critical minerals development, particularly lithium, with Argentina currently looking to surpass Australia and Chile as the leading global lithium producer. Unfortunately, growing resource nationalism in several key countries like Bolivia, Chile, and Mexico is impacting supply, and the countries seem more open to investments from China and Russia than the U.S. and its allies.

Fortunately, the U.S. has managed to make in-roads amidst the wrangling. Shortly after a January 2023 “Three Amigos” summit with the U.S. and Canada, the Mexican government announced plans to seek a renegotiation of terms, which included a joint commitment to collaborate on critical minerals. Additionally, Lilac Solutions, a U.S.-based startup backed by Breakthrough Energy Ventures, is currently the lone U.S. company seeking development rights in Bolivia.

Global Resource Competition: Asia

Click on each for more information

Several Asia-Pacific countries are also angling to benefit from their critical minerals endowments, particularly Indonesia, the global leader in nickel production.

After banning exports of raw nickel in a bid to encourage midstream refining investments, Indonesia is now proposing the creation of an OPEC-inspired cartel for major battery mineral producers. Despite the World Trade Organization (WTO) recently finding this ban in breach of international trade rules, the Philippines is now following suit and considering a similar ban or a new export tax.

With foreign nickel access looking precarious in Asia, Vietnam has emerged as a promising non-China alternative for rare earth elements. Vietnam has received ongoing investments from Japan, a cooperation agreement with South Korea, and interest in investments from Canada through the Trans-Pacific Partnership and from Europe through their FTA.

Securing Supply Chains Through Innovation

Technological innovation has a major role to play in reducing critical minerals supply chain risk, with the potential to reduce the growth rate of demand for these minerals, unlock new sources of supply, and develop substitutes to replace them altogether.

Recycling from scrap and waste already accounts for a substantial share of global supplies of nickel, niobium, tantalum, and tungsten, and high-tech recycling approaches hold promise for other key critical minerals. Roughly 90 percent of the lead-acid batteries from today’s conventional cars (along with 90 percent the steel) are recycled, and achieving similar recovery rates for lithium-ion batteries holds the promise of effectively reshoring supply chains for lithium, cobalt, and nickel beyond what mining alone could provide.

While it will take years for EV batteries on the road today to reach their end-of-life, battery recycling could provide as much as 15 percent of lithium, 7.5 percent of nickel, and 43 percent of cobalt required to meet battery demand by 2030, if the recycling sector has achieved sufficient scale by then. The size of this potential market, along with growing policy support, has encouraged major investments in a variety of startups in the battery-recycling sector.

Recycling of gallium and REEs is also an area of growing focus of the U.S. Department of Defense, with a $30 million DPA investment in REE magnet recycling company Urban Mining and a research program sponsored by DARPA (Defense Advanced Research Projects Agency) to develop new techniques for recycling critical minerals. The DARPA Recycling at the Point of Disposal (RPOD) program is seeking to develop small-footprint platforms for extracting a variety of minerals from growing e-waste streams, including REEs, gallium, indium, and tantalum.

Innovation also has a role to play in making mining more environmentally sustainable, which is becoming essential to securing permits from regulators, social license to operate from communities, and project financing from investors focused on environmental sustainability, governance, and human rights. For example, in-situ recovery techniques reduce the environmental disruption of mining for uranium and other minerals by dissolving the desired materials from well boreholes instead of excavating them from ore. Similarly, direct lithium extraction (DLE) techniques that remove lithium from brines without the need for evaporation ponds can reduce the water consumption of lithium operations, a key concern for lithium production in areas such as northern Chile and California’s Salton Sea. Moreover, “full-value mining” or “nose to tail mining” seeks to use new approaches to extract additional minerals from waste streams and byproducts of existing mines.

Finally, many of the clean energy, transportation, and aerospace industries that rely on these critical minerals today have opportunities to innovate and substitute, reduce, or eliminate these requirements. The evolving chemistries of lithium-ion batteries is a case in point—increasing amounts of nickel have been used to substitute for the cobalt used in cathodes, and as discussed previously in this analysis, a growing number of carmakers, including Tesla, are using lithium iron phosphate (LFP) batteries that eliminate the need for both cobalt and nickel, trading the energy density offered by high-cobalt batteries for greater supply chain security and price stability.

Sodium-ion batteries are another emerging chemistry that uses earth-abundant materials, eliminating cobalt and nickel and using a sodium-based electrolyte in place of lithium. Like LFP batteries, sodium-ion chemistries offer up to 20% lower costs but also lower densities than cobalt-containing chemistries – and, also similar to LFP, the Chinese battery giant CATL is set to become the first company to scale up their manufacture, with plans for mass-production starting this year for use in a hybrid sodium-ion and lithium-ion EV battery pack.

Looking Ahead—Securing Washington State’s Critical Industries

Beyond the critical minerals discussed above, all of these technologies are also dependent on copper to varying extents. Copper is used in the motors that propel ZEVs, the zero-emission power generation technologies cleaning up the grid, and the transmission and distribution wires that connect them. While copper is not classified as a critical mineral due to a relatively diverse set of suppliers around the world, the global clean energy transition could lead copper demand to nearly double by 2035, posing a growing risk of supply shortfalls in the coming decades. The importance of copper has led a group of U.S. senators to petition for copper to be added to the USGS critical minerals list—a call that has become more urgent due to an escalating political crisis in Peru, the world’s second-largest producer.

As policymakers and businesses across Washington state think through and refine strategies to reach clean energy goals while fostering growth, staying attuned to evolving supply, demand, and geopolitical dynamics affecting critical minerals and materials will be vital to supply chain resilience and maintaining competitiveness across the state’s tech-driven industrial base. It will also inform ongoing efforts to build-out advanced technology projects in the state and across the region.

Publication date: March 2023

By John Atkinson (Contributor, FP Analytics) and Allison Carlson (Executive Vice President, FP Analytics & FP Events).

FP Analytics, the research and advisory division of Foreign Policy, produced this issue brief, which was commissioned and made possible with financial support from JCDREAM- the Joint Center for Deployment and Research in Earth Abundant Materials. Editorial control has been retained by FP Analytics.