Powering the AI Era

Meeting energy goals amid the AI boom in Washington State

Produced by FP Analytics with support from JCDREAM

OCTOBER 2025

In a two-part issue brief series commissioned by JCDREAM, FP Analytics examines how AI advancements are driving demand for electricity and critical minerals and impacting clean energy goals, with a particular focus on Washington State. Part 1 explores the implications of the AI boom for energy consumption, the economy, and communities. Part 2 analyzes the impacts of AI development on demand for critical minerals and supply chains. The analysis breaks down state, regional, and national policies, the roles of the public and private sectors, and the context of global trade and geopolitics, bringing sharpened focus on issues that are of growing interest to policymakers, industry, and the broader public in Washington State and beyond.

PART 1

Introduction

Ushering in an “age of electricity,” global electricity demand is projected to rise by 4 percent annually through 2027, its fastest sustained growth in decades. The increase is fueled by a variety of factors, including global increases in manufacturing, air conditioning, and electric vehicles (EVs). But one crucial emerging factor has been the growth of artificial intelligence (AI). Soaring demand for AI development and integration is leading to a surge in the construction of data centers, which support the development and operation of AI. Data centers’ global energy needs are forecast to rise from 415 TWh (terawatt-hours) in 2024 to 1,200 TWh, or potentially as high as 1,700 TWh, by 2035. For comparison, this upper estimate is nearly equal to India’s annual electricity use, signaling the massive cumulative energy required to power AI.

The proliferation of data centers has also become a major driver of electricity demand in the United States. Power required for U.S. data centers could grow to 580 TWh by 2028, roughly twice the annual electricity usage of California. This rapid growth is already straining regional power grids and placing environmental, social, and economic pressures on the communities proximate to where data centers are located, as highlighted by this report’s analysis of Washington State.

In terms of climate goals, the race to advance AI has prompted a re-evaluation, and even potential disruption of, decarbonization policies and plans at the global, national, and local levels, while driving market trends that exceed current limitations in energy infrastructure. At the same time, AI advances have the potential to harness underutilized energy sources such as nuclear, hydrogen, and geothermal—as well as increase the efficiency of power generation and transmission. These factors may determine whether AI development ultimately delays, or potentially accelerates, progress toward clean energy goals.

How the Rise of AI Impacts Demand for Power and Resources

The AI sector began attracting major investments in late 2022 following the release of ChatGPT, an AI chatbot that responds to prompts using generated text, voice, and images. And that investment has continued to grow. In 2025 alone, the biggest U.S. technology companies are set to invest more than USD 300 billion on AI development, computer hardware, and new data centers. Over the next five years, investment could reach USD 1 trillion in the U.S., plus another trillion internationally. Microsoft, which is headquartered in Washington State and has the state’s largest data center capacity, was set to invest USD 80 billion in 2025 to build out data centers globally, most of which was intended for the United States, although reports of a pullback from spring 2025 indicate the company may be re-evaluating the speed of this buildout. Companies’ evaluation of a range of evolving market dynamics could affect the ultimate rate of investment and development.

FIGURE 1

AI and Data Center 101

AI runs on large, often hyperscale, data centers that provide massive computing power, storage capacity, high-speed networking, and power and cooling infrastructure.

What is a data center?

A facility that hosts computing machines and their supporting equipment, including:

Network

Storage

Power

Cooling systems

An AI-specialized data center hosts machines with advanced computing power to train and deploy AI applications and services.

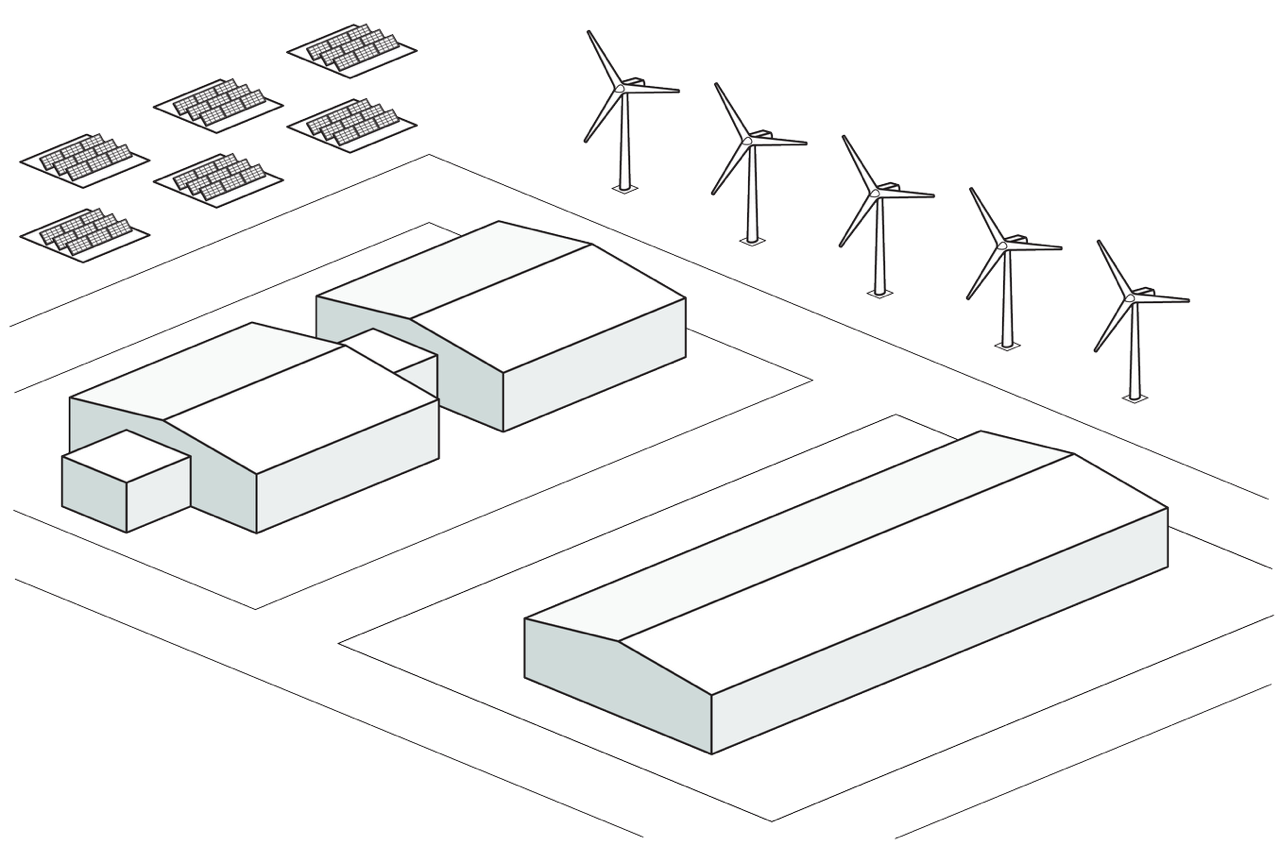

FIGURE 2

Inside a Data Center

Applications for AI

Predictive AI

Demand forecasting, credit risk scoring

Generative AI

Text, image, video, or speech outputs

Computer Vision

Facial recognition, object detection for self-driving cars

DATA SOURCES: BARROSO ET AL. (2019), BERKELEY LAB, DATA CENTRE DYNAMICS, IBM, IEA

The rise in AI investment comes with a parallel increase in electricity demand in the United States. In 2018, data centers accounted for about 76 TWh, or 1.9 percent of national electricity demand. By 2023, this figure had more than doubled to 176 TWh, or 4.4 percent of total U.S. electricity demand.

In the next five years, forecasts indicate that the growth of AI-driven data center construction will continue unless hampered by energy supply or other potential bottlenecks. By 2028, Berkeley Lab projects a range of pathways in which data centers’ electricity demand in the U.S. could almost double to 325 TWh, representing 6.7 percent of U.S. electricity demand, or even nearly triple to 580 TWh, representing 12 percent of U.S. electricity need. To meet total demand by 2028, which is also rising from growth in manufacturing, EVs, and other sources, utilities across the U.S. will need to increase electricity generation by up to 26 percent and expand and overhaul transmission grids across the country. The latter may prove to be a daunting task, given that securing approval for new transmission projects could take as long as 17 years.

FIGURE 3

Distribution of U.S. Data Centers

Virginia, Texas, and California to see highest data center electricity consumption by 2030; Washington among the top secondary markets.

Hover over circles for more information

FIGURE 4

Data Center Projected Power Consumption

Under a moderate-growth scenario, U.S. data center power consumption could increase by 5 percent annually through 2030.

Hover over each state to see electricity consumed in 2023 and projections for 2030

DATA SOURCES: DATACENTERMAP, EPRI

Note: EPRI only included 44 states that had noticeable data center load in 2023 for its 2030 electricity load projections.

Data centers are also projected to constitute the largest share of new electricity demand among industries. One estimate suggests that the data center boom could account for 44 percent of new U.S. electricity demand from 2023 through 2028. As of 2024, the availability of data center facilities remained tight. Most are leased out, with a vacancy rate of just 5 percent among 569 facilities across the United States, and with 83 percent of facilities under construction already pre-leased. The low vacancy rate signals high demand for data center buildout in the immediate term.

The growing gap between AI’s voracious energy appetite and the slow pace of developing and updating clean energy infrastructure is producing several market trends. First, new data centers are being located primarily based on power availability and distribution capabilities rather than on other factors—such as tax rates or proximity to employees or population centers—that previously held more weight in those decisions. Data facilities are increasingly built in rural areas where land is plentiful, there are fewer competing needs for power, and there is often less local opposition to their construction.

Second, companies are investing in more efficient AI architecture—such as smaller or more specialized language models—and infrastructure, such as design changes to Amazon Web Services’ liquid cooling approaches that produced a 46 percent reduction in mechanical energy consumption. The investments reflect that energy efficiency is not just an environmental imperative, but also a competitive business advantage.

Behind-the-meter energy is produced, stored, and used at the same location without passing through the broader electrical grid.

Third, the biggest U.S. tech companies are increasingly taking control of their energy procurement with a focus on, but not limited to, clean energy. With recent increases in their power consumption, driven by AI developments, these companies are buying more low- and zero-carbon energy generation, accounting for more than half of the total U.S. corporate clean energy procurement as of 2024. Companies are also increasingly investing in behind-the-meter solutions such as onsite solar, battery storage, and microgrids, and betting on alternative sources of clean energy, particularly nuclear, by pursuing small modular reactor (SMR) projects or extending the licenses of retired nuclear plants. For example, Microsoft signed a 20-year purchase agreement for power from the Three Mile Island nuclear reactor. Given the strong political and economic interest in accelerating AI data center buildout, and the significant capital resources available for that purpose, trends such as pairing new data centers with behind-the-meter energy generation and storage are likely to continue.

How the AI Boom Is Impacting Washington State

Washington State is the 9th-largest data center market in the United States in terms of electricity demand, at 5.17 TWh. Data centers represent about 5.7 percent of total electricity demand in the state. Washington’s relatively low power rates, due to its abundant hydropower; the presence of Amazon and Microsoft headquarters; and the proximity to fiber-optic subsea cables that connect across the Pacific make the state an attractive hub for data centers. Washington hosts 113 data centers as of May 2025, with at least eight additional sites under construction. Most facilities under construction are located in Grant County, which is home to 50 data center sites.

In the next five years, under a high-growth scenario, the electricity demand of data centers in Washington could double, accounting for about 10 percent of the state’s electricity usage. The Northwest Power Conservation Council, responsible for developing a regional power plan for Idaho, Montana, Oregon, and Washington, sees data centers and chip fabrication as main drivers of power demand in these states, anticipating between 2.4 GW (gigawatts) and 4 GW of additional load by 2029. If the data center demand were to hit 4 GW, it could strain the power system, leading to heightened risks of power shortfalls. Under this high-growth scenario, utilities in Washington State may be forced to import higher-priced, nonrenewable electricity; divert river flows reserved for fish and other wildlife so that dams could produce more hydropower; or, in the extreme case, ask the public to conserve power or risk blackouts. These potential outcomes could disrupt local livelihoods and undermine the well-being of communities that depend on stable, affordable access to electricity and the sustainability of local resources.

FIGURE 5

Data Center Electricity Demand

Data center electricity demand could double by 2030, although the impacts of AI on energy demand remain highly uncertain.

United States

Washington State

DATA SOURCES: BERKELEY LAB (HISTORICAL), EPRI, IEA

Note: Authors used base-case forecasts of IEA and estimated percent of U.S. total using EIA forecasts including average growth per year. On EPRI, the following were growth assumptions: 3.71 % for low growth, 5% for moderate growth, 10% for high growth, and 15% for higher growth scenario.

Since 2024, certain regions within Washington State have experienced grid pressures. Despite having substantial hydroelectric power from dams on the Columbia River, Grant County is facing an “energy crunch” due to the increased demand from data centers. Since data centers tend to be spatially concentrated, spikes in electricity demand are expected to be felt hyper-locally. In addition, the rapid growth of data centers risks crowding out other commercial, residential, and industrial development. For these reasons, localities in other states, such as Atlanta, Georgia, and Fairfax County, Virginia, have restricted data center construction near transit hubs, public parks, and residential zones.

Rising electricity demand could also increase electricity and property prices. In Loudoun County, Virginia, which has the highest concentration of data centers in the world, property values of residential homes have increased by 12 percent since 2023. Across the United States, monthly wholesale electricity prices in areas near major data center hubs have surged by as much as 267 percent compared to five years ago, with early analysis indicating that these increases are being passed on to consumers through higher monthly power bills. While the effect of rising power demand still appears to be relatively muted in Washington State, farmers in Grant County have raised concerns about potential price hikes amid the data center boom.

In other parts of Washington, data center development is on the upswing, particularly in Walla Walla, Chelan, and Douglas Counties. In Walla Walla, a USD 5 billion plan for a data center campus has been approved by the Port of Walla Walla commissioners and is now under a due diligence process. An undisclosed tech company plans to construct 16 data centers in four phases across 500 acres of land, bringing in construction and IT jobs and increasing the local tax base. But questions persist about the resources needed to operate this massive data center campus. Community members at a Port of Commission meeting highlighted the strain on electricity and water usage, noting that the project will source its water from the Columbia River, which is already a major source of electricity via hydroelectric dams, and water for existing data centers in Washington and neighboring Oregon. Moreover, given the project’s proximity to the Umatilla Indian Reservation, residents have urged consultation with indigenous communities about the project. The noise and light pollution have also emerged as areas of concern for residents, including the potential for health risks that warrant further study.

Unresolved questions about the impacts of data centers and AI development more broadly on local populations extend beyond Washington. In the U.S., local grievances are growing to new developments, especially in the hotspots like Northern Virginia, Atlanta, and Phoenix. Moreover, globally—especially in impoverished and underserved contexts—there is also growing concern about how the advent of AI is widening inequalities and adversely impacting lives and livelihoods. The dependence of AI development on mining and other extractive industries as well as the high energy and water demands of the data center supply chain warrant closer attention from relevant stakeholders in the public and private sectors to mitigate harms on men, women, and children. As the race to power AI accelerates, it is crucial to address the social, economic, health, and environmental impacts, and to ensure that the voices and needs of local communities are reflected in policies, investments, and programs.

How Washington’s State and Local Policies Impact AI’s Energy Demands

Because AI’s energy needs are concentrated in data centers, state and local policies play an important role in moderating AI’s economic and environmental impact on surrounding communities. In the case of Washington State, a series of policy decisions have resulted in increased strain on the energy grid, and particularly on the states’ renewable energy resources, threatening the viability of its renewable energy targets.

Since 2010, Washington has provided sales tax breaks to data centers. Initially, the tax breaks were intended to attract high-paying jobs to rural areas. Job creation requirements have since been loosened in favor of labor standards and property tax revenue generation, and in 2022, eligibility for the tax breaks was broadened to urban areas as well. Though the economic benefits of these tax breaks are debated, there is evidence that they are leading to expanded development and influencing the siting of data centers. (For example, Microsoft has previously moved servers out of state during periods when these tax breaks have lapsed.) By successfully attracting data center development, the breaks have contributed to an overall increased demand on the state’s energy grid.

At the same time, Washington State has ambitious goals to decarbonize its energy grid. In 2019, the state legislature passed a Clean Energy Transformation Act, which committed the state to achieving an electricity supply free of greenhouse gas emissions by 2045, and to making utilities carbon-neutral by 2030. But with electricity consumption from AI and data centers predicted to double from 2023 through 2026, those targets are becoming tougher to reach. From 2000 through 2022, the share of Washington’s power that came from renewable sources fell from 67 to 61 percent, despite the state adding wind and solar capacity over that time to supplement hydropower, its primary renewable energy resource.

Rural areas that previously had abundant renewable energy—such as Grant County, which contains several large dams providing hydroelectric power—have been particularly affected by AI. In 2022, data centers consumed nearly 40 percent of Grant County’s energy. To meet these rising demands, the county signed contracts with energy companies to import a steady supply of electricity from unspecified sources, which typically rely on carbon-emitting fuels. But by 2030, state law will sharply limit such imports. As a result, local officials report that they fear rolling blackouts in homes, factories, and hospitals within six years. Unless policies and investments secure energy access for communities, these projected power shortages could undermine critical infrastructure and have serious economic and social implications for Grant County, affecting the livelihoods of residents and disrupting essential services.

In response to these issues, in February 2025, governor Bob Ferguson ordered a study on data centers’ impact on energy use, state tax revenue, and job creation. In April 2025, Grant County’s Public Utility District imposed an electricity load cap on data centers, effectively limiting the construction of new data centers until the utility’s planned transmission expansion is complete. However, data centers provide over 25 percent of Grant County’s tax revenue, so officials may be reluctant to take steps that risk pushing the industry out entirely.

How Energy Stakeholders Can Collaborate to Meet Energy Transition and Security Goals

Both the growth of AI and climate change are global trends, affected by national policies, with locally concentrated energy impacts. Because these trends have causes and implications that stretch across sectors, industries, and countries, efforts to address the energy challenges presented by their intersection require extensive coordination among private-sector leaders, government officials, and civil society representatives at all levels. Below are recommendations and considerations for making that coordination effective and well-rounded.

Coordinating across sectors to ensure alignment in clean energy goals

Given AI’s rapid rise, states, communities, and major businesses need to work together to evaluate and align their clean-energy goals, focusing on their cumulative carbon footprint rather than how emissions are allocated among their activities or localities. Without a transparent and holistic view that incorporates the spillover effects of each stakeholder’s actions on the other, companies risk greenwashing the full effect of their operations, while state-level green energy targets risk pushing carbon emissions into neighboring states instead of achieving overall reductions.

Tech companies, grid operators, policymakers, and local communities can also collaborate to develop demand response programs that reduce data center workloads during peak hours. With investments in sensors, batteries, and data analytics, today’s “smart grids” can adjust power flow based on real-time demand. Data centers can integrate with these systems to shift workloads to off-peak hours, reducing the need to rely on fossil fuels.

Adapting energy policies in the age of AI

In light of the changing market dynamics presented by the AI boom, Washington State can re-examine which tax incentives are appropriate for data centers. To balance environmental and economic interests, one option may be to condition tax breaks on standards for energy efficiency or the use of green power at data centers. Similar legislation has been considered in Virginia and other states. Washington State could also explore opportunities to repurpose retired coal plant sites or other decommissioned power facilities as green data center hubs to reduce the need for entirely new developments.

Finally, streamlining local permitting processes for clean energy and transmission projects is essential to help meet rising demand. The Washington State legislature has already taken promising steps in this direction, creating a Clean Energy Coordinated Permit Process in 2023 that integrates reviews under the State Environmental Policy Act (SEPA) and consolidates state and local permits for eligible projects to shorten approval timelines. Further progress could be made by following the recommendations of a 2024 report to the Washington Department of Commerce, which included creating specific timelines for each step of the SEPA process, standardizing mitigation measures and guidance, and creating a Washington Renewable Energy Authority to sell pre-permitted sites and establish high-priority transmission corridors.

Building smarter, cleaner, and more efficient AI and energy infrastructure

Tech companies involved in the AI space can evaluate pairing data center development with investments in behind-the-meter clean energy generation or purchase agreements. While suppliers to the broader energy grid may be able to keep pace with gradual increases in demand, behind-the-meter generation may be necessary to meet the sudden surge in demand that AI is expected to produce. Meanwhile, regulators at all levels can ensure that participating companies equitably share the burden of any resulting increases in costs to other consumers. In October 2024, the Federal Energy Regulatory Commission rejected an interconnection service agreement (ISA) that would have facilitated behind-the-meter power sales between a Pennsylvania nuclear power plant and a co-located Amazon data center. Central to the case was concern that the ISA would have forced ordinary ratepayers to shoulder a higher portion of energy transmission costs—an issue that AI developers will need to mitigate to assuage the concerns of state and local policymakers nationwide.

Despite these obstacles, encouraging data center developers to invest in co-located, zero-carbon energy generation is a more environmentally friendly alternative to relying on natural gas. Noting the clear roles of hydro and nuclear, solar power, wind power, and battery storage are among the most rapidly scalable and cost-competitive ways to meet increased energy demand. However, they come with challenges in light of shifting trade policies that may restrict access to key minerals and materials for renewable technologies, potential rollback of clean energy incentives, and environmental and social costs of mining these minerals. These issues will be explored further in Part 2 of this series. Investments in emerging energy solutions like advanced nuclear, green hydrogen, or next-generation geothermal may also be appropriate options for expanding access to low- and zero-carbon power.

AI firms can also invest in making data centers more energy-efficient, particularly through innovative liquid and immersion cooling systems and more efficient processors and GPUs. Similarly, researchers can harness advanced AI to accelerate research on green energy technologies and development of green energy projects. For example, an AI company called Paces is developing tools to assist clean energy developers with permitting, siting, interconnection, and environmental risk assessment for green energy projects. Similarly, PJM, the nation’s largest grid operator, is planning to use AI to overhaul the approval process for such projects, which could greatly reduce the current two-year processing time for new energy project applications.

Looking Ahead

The rapid advancement of AI is dependent on meeting its energy demands. In a world where 1.18 billion people still live in energy poverty, and where 2024 was the warmest year on record, the growth of AI-fueled data centers adds a critical challenge to meeting global clean energy and energy access goals. Because AI data center hubs tend to be spatially concentrated, specific locations—such as Grant County in Washington State—face especially acute pressures on their power grids. For these communities, and others around the globe who will be disproportionately impacted by the energy and mining demands of AI, waiting is not an option; the need for action is immediate.

To meet the energy consumption, data center buildout, and infrastructure expansion that AI requires, mining for critical minerals will need to be expanded. Without adequate precautions and safeguards, this could risk exacerbating existing labor and human rights abuses, particularly in indigenous and poor communities, while contributing to further environmental degradation in mining-heavy regions. Part 2 of this report explores in further detail the environmental and social consequences of sourcing critical minerals and other natural resources that underpin AI advancements.

Addressing the growing electricity demand amid resource constraints requires multistakeholder collaboration to set regulatory frameworks, align clean energy plans, invest in efficient energy generation, and upgrade existing energy infrastructure. Proactive and sustained coordination among sectors, with clearly defined roles, will help ensure that tech hubs such as Washington State continue to benefit from the AI industry without compromising their broader goals for climate resilience, energy access, and grid reliability.

By Angeli Juani (Senior Policy and Quantitative Analyst), Andrew Doris (Senior Policy and Research Analyst), Dr. Mayesha Alam (Senior Vice President of Research), and Allison Carlson (Executive Vice President, FP Analytics & FP Events). Art direction by Sara Stewart, lead illustration by Andrei Cojocaru, graphics illustrations by Colin Hayes.

This issue brief was produced by FP Analytics, the independent research division of The FP Group, with support from JCDREAM. FP Analytics retained control of the research direction and findings of this issue brief. Foreign Policy’s editorial team was not involved in the creation of this content.

.