Artificial Intelligence and the Critical Minerals Crunch

Strategies for resilient supply chains

Produced by FP Analytics with support from JCDREAM

OCTOBER 2025

The following research is the second installment in a two-part issue brief series commissioned by JCDREAM. Building on Part 1, which examined the impacts of the AI boom on energy consumption, Part 2 explores how AI development is driving demand for critical materials and challenging supply chains. In this issue brief, FP Analytics highlights elements behind recent advances in AI, particularly gallium, germanium, copper, palladium, indium, tantalum, rare earth elements (REE), silicon, and high-purity alumina. It explains how critical minerals fit into the broader landscape of geopolitical competition for technological supremacy, and offers recommendations to policymakers in Washington State and beyond on strengthening reliable and diverse supply chains.

PART 2

Introduction

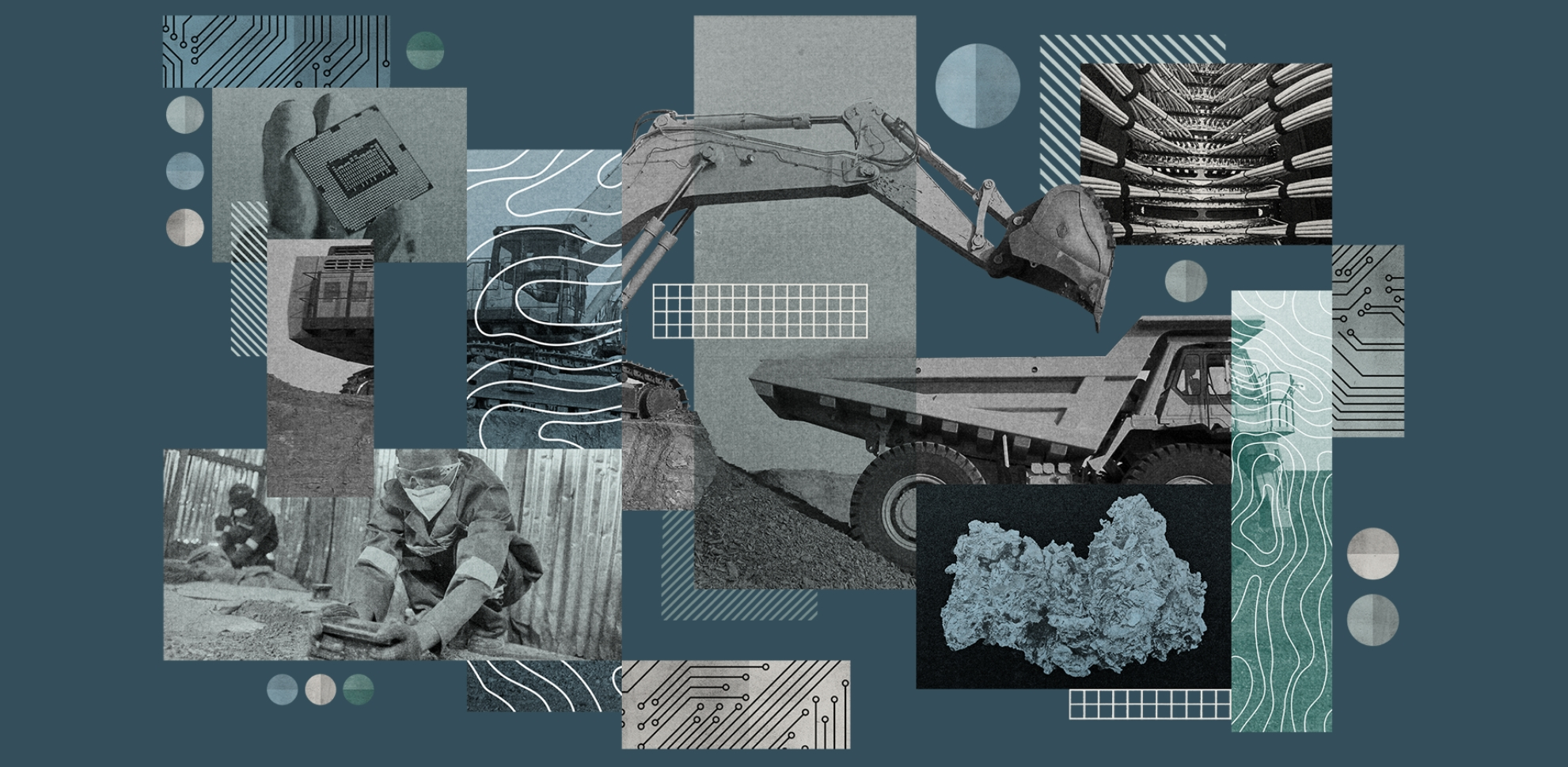

The artificial intelligence (AI) revolution runs on rocks, specifically a handful of critical minerals that power everything from advanced semiconductors to massive data centers. These non-fuel minerals, deemed essential to U.S. economic and national security by the Energy Act of 2020, have become the hidden foundation of the AI era.

While much attention has focused on battery minerals like lithium and cobalt for electric vehicles, the AI boom depends critically on lesser-known elements — particularly gallium, germanium, indium, palladium, and tantalum — that enable the high-performance chips at the heart of every GPU and data center. China controls 98 percent of global primary (low-purity) gallium production and 60 percent of germanium refining, creating vulnerabilities that dwarf even the well-documented risks in battery supply chains. Yet, despite their centrality to AI infrastructure, the extraction and processing of these minerals have received far less scrutiny regarding their environmental and human rights impacts.

Training a single AI model requires thousands of high-performance GPUs containing gallium arsenide semiconductors, while the accompanying infrastructure demands germanium-based fiber optics. These overlapping dependencies create compound supply risks, particularly as export control regimes evolve and geopolitical tensions escalate. Paradoxically, AI offers potential solutions, with machine learning algorithms increasingly deployed to accelerate mineral exploration, optimize extraction processes, and predict supply chain disruptions. AI is also expediting research on recycling technologies and the development of earth-abundant alternatives.

For Washington State, these dynamics have immediate consequences. Home to Microsoft, Amazon, and the nation’s ninth-largest data center market by energy consumption, the state exemplifies how AI’s mineral demands intersect with aerospace manufacturing (e.g., Boeing), defense systems, and clean energy infrastructure. The state’s goal of zero-carbon electricity by 2045 adds another layer of mineral competition, as renewable energy systems require many of the same materials. The human costs demand equal attention. Without robust safeguards, the AI boom risks amplifying the environmental and social harms already documented in traditional mining sectors.

This second installment in FP Analytics’ partnership with JCDREAM examines how AI is fundamentally reshaping critical mineral markets, with particular focus on gallium, germanium, copper, palladium, indium, tantalum, rare earth elements (REE), silicon, and high-purity alumina supply chains. Through analysis of extraction impacts on local communities and assessment of Washington State’s unique position, this report provides actionable strategies for securing resilient, responsible, and equitable mineral supply chains as AI development accelerates alongside climate imperatives.

Increasing Demand, Facilitating Supply: How AI Impacts the Critical Minerals Landscape

AI’s impacts on critical mineral markets manifest in three primary ways:

First, AI data centers consume large amounts of energy, consequently driving up demand for critical minerals crucial for energy generation, transmission, and storage. They rely on uninterruptible power supplies (e.g., UPS) with lithium-ion batteries for backup power during outages, adding another layer of mineral dependency. In addition, energy storage systems that require critical minerals are increasingly used not only for backup power but also to stabilize electricity supply, smoothing out fluctuations in high-frequency switching environments typical of AI infrastructure.

The systems powering data centers require copper (power transmission, wiring, cooling systems); aluminum (server racks, cooling plates); gallium (power converters); and rare earth elements or REEs (magnets). According to the International Energy Agency (IEA), data center buildout could boost global demand by 2030 by approximately 2 percent for copper, 3 percent for REEs, and up to 11 percent for gallium. For example, an additional 512 kilotonnes of copper will be needed by 2030 for data centers, while global copper supply is projected by IEA to face a shortfall by 2035.

In Washington State, the rapid expansion of AI-driven data centers coincides with ambitious renewable energy targets, including achieving zero-carbon electricity by 2045 and adopting 100 percent zero-emission vehicles by 2035. These goals heighten demand for clean energy minerals such as lithium, cobalt, nickel, and REEs. AI data centers further intensify this demand, amplifying supply risks for Washington’s clean energy and economic sectors. A stable supply is critical for clean energy goals and sectors like aerospace and defense.

Second, advanced AI chips necessitate powerful semiconductors, which rely extensively on critical minerals including gallium, germanium, indium, palladium, tantalum, and silicon. The U.S. remains substantially dependent on China and Russia for these minerals, creating economic and national security risks. As advanced AI becomes increasingly integral to business, government, and military applications, demand for independent and secure sources of these minerals is projected to surge dramatically.

Gallium and germanium extraction presents unique challenges that compound supply risks. Gallium, used extensively in high-performance chips, and germanium, integral to fiber optic cables and high-speed transistors, pose particularly acute supply chain risks. According to the U.S. Geological Survey (USGS), even a 30 percent disruption in gallium supplies could cause a USD600 billion reduction in U.S. economic output, equating to more than 2 percent of GDP. It is primarily obtained as a byproduct of aluminum smelting, with China controlling 98 percent of global production through its massive aluminum industry. The extraction process involves treating bauxite ore with caustic soda at high temperatures, creating significant environmental impacts, including red mud waste, which can contaminate water sources.

Germanium extraction, primarily from zinc ores and coal fly ash, involves complex chemical processes using hydrochloric acid and distillation. China’s dominance in germanium (over 60 percent of global refining) stems partly from its willingness to process coal fly ash despite the associated air quality and waste management hazards. Workers in germanium-processing facilities face exposure risks to inorganic germanium compounds, which can cause respiratory, kidney, and liver issues.

FIGURE 1

Critical Minerals Required for AI Applications

AI microchips and data center technologies rely on a handful of critical minerals, many of which face supply chain risks due to geopolitical concentration and rising demand. This graphic highlights key minerals essential for AI applications, summarizing their primary uses, sourcing countries, trade vulnerabilities, and relevant policy updates shaping their markets. Ensuring resilient AI supply chains will require diversifying sources, investing in recycling, and developing alternatives for these critical minerals to mitigate rising trade and geopolitical risks.

Data sources: USGS (2023), USGS (Silicon Statistics and Information)

Silicon

Key application in AI

Semiconductor wafers for microchips

Trade/policy vulnerability

High U.S. reliance on Germany, Taiwan, and Brazil for high-purity silicon used in AI-chip production

Source country for U.S. imports

Gallium (refined metal)

Key application in AI

High-performance AI chips (e.g., GaN, GaAs semiconductors)

Trade/policy vulnerability

2023 Chinese export controls raised prices 50–100% outside China

Source country for U.S. imports

Note: The grid shows U.S. import sources of refined gallium metal. Globally, China dominates production of primary low-purity gallium, accounting for ~98% of supply capacity.

Germanium

Key application in AI

Fiber optics, infrared optics, high-speed transistors in AI systems

Trade/policy vulnerability

Chinese export controls implemented in 2023; U.S. supply highly vulnerable

Source country for U.S. imports

Note: While U.S. import data list Belgium as a source of germanium and palladium, this likely reflects Belgium’s role as a re-export hub. The materials originate elsewhere, primarily China.

Copper (refined)

Key application in AI

Data center power transmission, server cooling systems

Trade/policy vulnerability

IEA projects global copper shortfall by 2035

Source country for U.S. imports

Palladium

Key application in AI

Advanced AI chips and sensors, electrical contacts

Trade/policy vulnerability

Sanctions on Russia could constrain supply, raising global prices

Source country for U.S. imports

Note: While U.S. import data list Belgium as a source of germanium and palladium, this likely reflects Belgium’s role as a re-export hub. The materials originate elsewhere, primarily China.

Neodymium/Rare Earth Elements (REEs)

Key application in AI

Magnets in AI data center cooling fans, robotics, and autonomous systems

Trade/policy vulnerability

High market concentration; recent Chinese export restrictions target REEs

Source country for U.S. imports

High-Purity Alumina

Key application in AI

Substrate material for AI chip wafers, LEDs

Trade/policy vulnerability

Prices stable but smelter production dominated by China raises strategic concerns

Source country for U.S. imports

Third, AI can be harnessed to accelerate and expand the discovery, extraction, and production of critical minerals, which will be crucial to ensuring supplies keep pace with surging demand. A 2023 report from the U.S. Department of Energy described how AI could scour vast datasets — including remote sensing, cartographic, geochemical, geophysical, and mineralogical information — to identify mineral locations, estimate volumes and grades, and evaluate economic feasibility. More recently, a 2024 Nature Communications study highlighted AI’s potential to optimize mineral mapping, estimate mine life, improve productivity, shorten preparation times, and reduce investment risk. The rapid expansion of these datasets in both volume and complexity has outpaced the capacity of traditional analytical methods, leading to longer discovery timelines and underutilized resources.

In response, initiatives such as the Defense Advanced Research Projects Agency’s (DARPA) Critical Mineral Assessments with AI Support (CriticalMAAS) competition aim to automate and accelerate mineral assessments, while the U.S. Department of Defense in 2024 announced an AI program to approximate mineral prices and supplies. Additionally, the U.S. Geological Survey has developed CriticalMAAS to streamline critical mineral assessment workflows. The private sector is also advancing this frontier: for example, a startup is using machine learning to pinpoint new mineral deposits, while other firms deploy predictive algorithms to optimize exploration drilling and reduce costs.

Recent Developments in the Critical Minerals Landscape

Since the 2023 analysis by FP Analytics, produced in partnership with JCDREAM, the dynamics of supply and demand have shifted considerably due to technological advancements, geopolitical tensions, and economic shifts.

The high concentration of market control, particularly in refining processes, remains a critical challenge, with China dominating the global landscape. China’s outsized influence on mineral processing, especially in 30 key REEs — where it accounts for approximately 70 percent of global production and nearly 90 percent of global processing — poses substantial risks for supply chain stability and price predictability. Its market control extends beyond traditional rare earths to lesser-known but equally critical minerals. In addition to gallium and germanium, China produces 80 percent of tungsten and 85 percent of magnesium. These minerals are essential for AI chips, fiber optics, and advanced alloys. This concentration creates unique vulnerabilities for technologies at the heart of the AI revolution.

Recent price fluctuations underscore these vulnerabilities. From 2022 to 2023, oversupply drove down lithium prices by 75 percent and cobalt, nickel, and graphite by 30 to 45 percent. Conversely, gallium and germanium prices have increased since 2023 due to their relative scarcity and rising demand from emerging technological industries, notably those involving advanced semiconductors and AI infrastructure.

The IEA’s Energy Transition Mineral Price Index further illustrates this volatility, tripling from 2020 to 2021 before relinquishing most of those gains by late 2023. This price volatility presents a complex scenario for the United States. On one hand, lower mineral prices have made renewable energy technologies economically more viable, facilitating the growth of sectors such as electric vehicles and manufacturing. On the other hand, inexpensive minerals from China have undermined the economic rationale for U.S. domestic mineral extraction and refining investments, injecting considerable uncertainty into future pricing and returns.

Demand for critical minerals is anticipated to continue rising significantly, particularly for clean energy applications, with projections indicating demand could quadruple by 2040. Additionally, the infrastructure needed for AI technology (including data centers and advanced microchips) is driving substantial new demand. A single large language model training run can require thousands of high-performance GPUs, while the accompanying data center infrastructure demands germanium-based fiber optic cables for high-speed data transmission. These AI-specific needs are projected to increase germanium demand by 37 percent and gallium demand by 85 percent by 2033. Nevertheless, several bottlenecks constrain supply growth, potentially leading to significant shortfalls and higher prices. China, despite its market dominance, is projected to encounter shortages in germanium by 2040, with demand set to double due to increasing AI-chip production. Current recycling capabilities can only fulfill about 30 percent of the future germanium demand, underscoring the critical need for enhanced recycling technologies and alternative sources.

Investment horizons compound these supply challenges. The IEA indicates that new mining projects typically require an average of 16 years from discovery to production. These prolonged timelines, coupled with recent mineral price volatility, significantly deter investor enthusiasm, thereby exacerbating potential supply gaps.

Consequently, by 2035, the global lithium supply is projected to meet only half of anticipated demand, and copper production is forecasted to cover merely two-thirds of global requirements. These shortfalls translate into concrete disruptions: delayed data center construction as companies compete for limited copper wiring and cooling systems, stalled AI chip production when germanium supplies tighten, and potentially tripled prices for critical components. For Washington State, tech companies may face choosing between expansion plans and sustainability commitments, while smaller firms could be priced out entirely.

How Geopolitics Complicates the AI-Critical Minerals Nexus

As prior FPA research has documented, critical minerals have emerged as a critical frontier of geopolitical competition, intricately tied to the broader rivalry over technological supremacy and environmental leadership among global powers, especially the United States and China. The intersection of advanced artificial intelligence (AI), clean energy ambitions, and national security concerns has intensified competition, resulting in increased friction and complex regulatory dynamics.

China’s strategic position reveals the depth of U.S. vulnerabilities. Its strategic dominance in critical mineral supply chains extends beyond its refining capacity. The country actively imports raw minerals from diverse sources across Asia, Latin America, and Africa to feed its processing industry, which is bolstered by substantial state subsidies and incentives. For example, government-backed expansion of China’s aluminum sector enabled a tenfold increase in production between 2000 and 2022 — cementing China’s global control over gallium.

This dominance translates directly into U.S. supply chain exposure. The U.S. remains highly exposed to these concentrations in supply. Of the 54 critical minerals identified by the U.S. Geological Survey, the U.S. is entirely import-dependent for 15 and more than 50 percent import-dependent for another 31. Beyond China, smaller producers offer insights into alternative extraction methods and their impacts. Russia produces approximately 5 percent of global gallium through its aluminum industry. Belgium serves as a key re-export hub for germanium, though investigations have revealed minimal oversight of origin documentation, potentially enabling circumvention of export controls.

These structural vulnerabilities have sparked an escalating cycle of trade restrictions. Between 2023 and 2025, reciprocal restrictions between the United States and China significantly impacted the critical mineral and technology trade landscape. China implemented stringent export controls on several critical minerals, including gallium, germanium, antimony, graphite, tungsten, tellurium, bismuth, indium, and molybdenum, directly affecting U.S. industries reliant on these resources for advanced technological and military applications. Concurrently, the United States enacted its own restrictions, exemplified by tariffs on Chinese imports and an April executive order initiating an investigation into the impacts of processed critical minerals. These policies have primarily targeted exports of advanced microchips and technologies necessary for sophisticated AI models, advanced weaponry, and supercomputing capabilities.

Recent diplomatic maneuvers have only intensified the mineral competition. In late June 2025, shortly after President Trump announced a limited trade agreement with China that notably excluded technology and critical minerals, Beijing imposed new export licensing rules for REEs. These rules require foreign buyers to disclose end-use applications, effectively restricting REE access for U.S. military and advanced technology sectors. As of October 2025, Beijing added five more rare earths to its exports control list and signaled that export licenses would be withheld from arms manufacturers and select semiconductor firms. These moves were widely interpreted as calculated steps to retain strategic leverage in ongoing U.S.- China negotiations, underscoring the pivotal role critical minerals now play in geopolitical power dynamics.

The economic consequences are already materializing. Escalating export controls and resource nationalism have direct financial implications as well, particularly for products reliant on critical minerals. For instance, similar restrictions in late 2024 led to gallium prices outside China doubling within five months, indicating how quickly supply chain disruptions can translate into significant market volatility. Continued resource nationalism and export controls are likely to exacerbate this trend, potentially driving costs significantly higher for sectors dependent on these minerals, including AI-driven data centers in regions like Washington State. Currently, the direct impacts of gallium and germanium restrictions have been modest for the U.S. semiconductor and defense industries, largely due to the re-exportation of these minerals through third countries such as Belgium. However, comprehensive export bans by China could dramatically alter this scenario, potentially resulting in a USD 3.4 billion decrease in U.S. GDP.

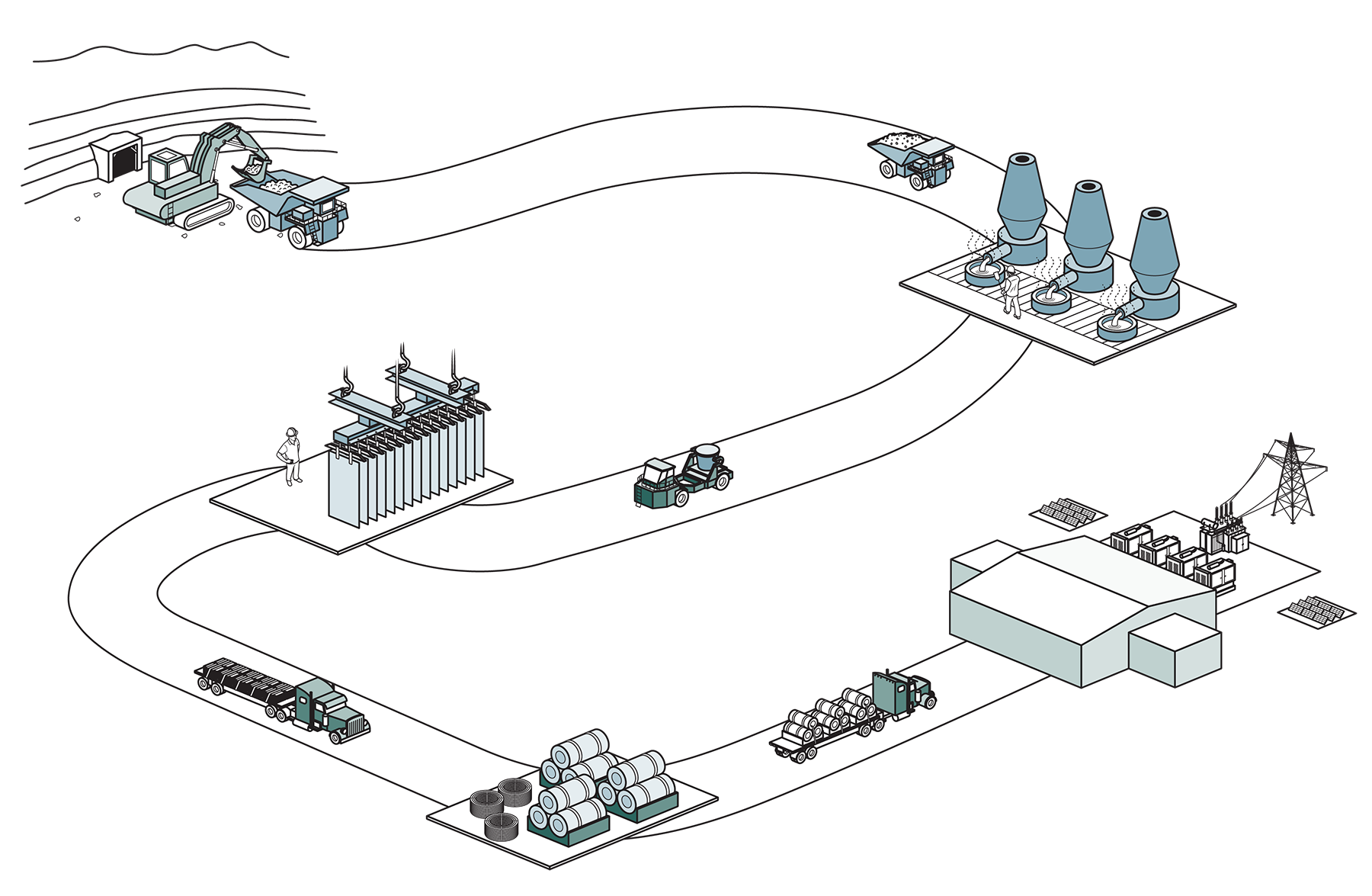

FIGURE 2

The Winding Path of Critical Minerals

Copper is essential to AI data centers, powering servers, cooling systems, and grid connections. This graphic traces copper’s complex journey from extraction to its final use in AI technologies, highlighting major geographic chokepoints and market vulnerabilities shaping supply security. Copper’s critical role underscores the need for diversified sourcing, expanded refining capacity, and accelerated recycling to build a resilient AI-enabled economy.

Key copper supply vulnerabilities

Import dependency

The U.S. imports ~37 percent of its copper supply; domestic production covers only ~63 percent of consumption.

Geopolitical risks

High concentration of reserves and refining in South America and China exposes supply to trade disruptions.

Investment gap

New copper mines require 15 to 20 years from discovery to production, limiting short-term supply flexibility.

Data sources: SMM (2024), IEA, USGS, S&P Global (2024)

The United States has scrambled to secure alternative sources. In response to the vulnerabilities posed by reliance on Chinese dominance, both the Biden and Trump administrations have undertaken strategic diplomatic initiatives aimed at diversifying and securing alternative sources of critical minerals internationally. The Biden administration launched the Mineral Security Partnership with fourteen nations and the European Union, explicitly designed to foster collaboration on diversifying critical mineral supply chains and reducing dependence on China. The Trump administration, meanwhile, pursued distinct bilateral agreements to secure critical mineral resources, notably through partnerships with Greenland and Ukraine. Additionally, a significant diplomatic effort culminated in a peace agreement between Rwanda and the DRC in June 2025, securing for U.S. companies preferential access to Congolese tantalum, gold, cobalt, copper and lithium. However, the mechanisms for protecting affected communities remain weak and leave communities vulnerable to environmental harms and displacement.

Despite these efforts, viable alternatives remain limited. Canada, endowed with substantial reserves of cobalt, graphite, nickel, and zinc, also represents a promising alternative trade partner. While Canada’s lithium and REE production volumes remain limited, its substantial reserves position it strategically as a reliable and geopolitically stable supplier. Securing diverse and resilient supply chains has become not just an economic imperative, but a national security priority. These vulnerabilities highlight the geopolitical nature of mineral supply chains. Diversifying sources and investing in resilient, transparent supply networks is essential to safeguarding U.S. technological competitiveness — especially for AI, clean energy, and defense applications.

The growing appetite for critical minerals also risks exacerbating environmental degradation and human rights abuses in resource-rich, but economically vulnerable, regions. A comprehensive life-cycle assessment of a primary gallium production plant in Shanxi Province reveals significant environmental burdens associated with gallium extraction from aluminum refining. The study identifies sodium hydroxide use and high electricity consumption as key contributors to environmental and human toxicity impacts in the plant’s operations. Sodium hydroxide is an industrial chemical needed to separate gallium from other materials. Producing a small amount of gallium generates chemical waste that can pollute water and soil and create health risks for workers, underscoring the sustainability challenges inherent in current gallium recovery processes.

Global investigations have documented over 100 allegations of human and labor rights violations across Chinese critical mineral projects involving aluminum (the source of gallium as a byproduct), chromium, cobalt, copper, lithium, manganese, nickel, zinc, and rare earth elements. In 2024, the U.S. banned copper imports from a Chinese company over Uyghur forced labor. As AI fuels greater mineral demand, policymakers and industry leaders need to address these environmental, labor, and community impacts to avoid deepening global inequalities. Left unaddressed, these inequalities can result in political instability, heighten the risk of violent conflicts, and lead to forced migration as communities lose access to their land or as environmental conditions worsen.

Adding further complexity, resource nationalism is surging among mineral-rich nations; in addition to the DRC, they include Chile, Bolivia, Indonesia, and Zimbabwe. These countries increasingly employ policies such as higher taxes, local processing mandates, or outright export bans to retain a greater share of value derived from their natural resources. In many cases, these policies are driven by legitimate aspirations to ensure that mineral extraction contributes to local economic development, industrial capacity-building, and long-term national prosperity. For example, Chile recently formed a state-owned enterprise to manage lithium extraction, significantly expanding government control and participation through public-private partnerships.

However, nationalist measures like this can also compound existing barriers to mineral access — especially for import-dependent countries like the U.S. — by introducing regulatory uncertainty or restricting global supply flows. Furthermore, these strategies may overlook or inadequately address the environmental and social costs borne by local and Indigenous communities. In Northern Chile, for instance, Indigenous groups have criticized government-led consultations around lithium mining projects as merely “performative,” raising concerns about insufficient participation in decisions that affect their land and livelihoods.

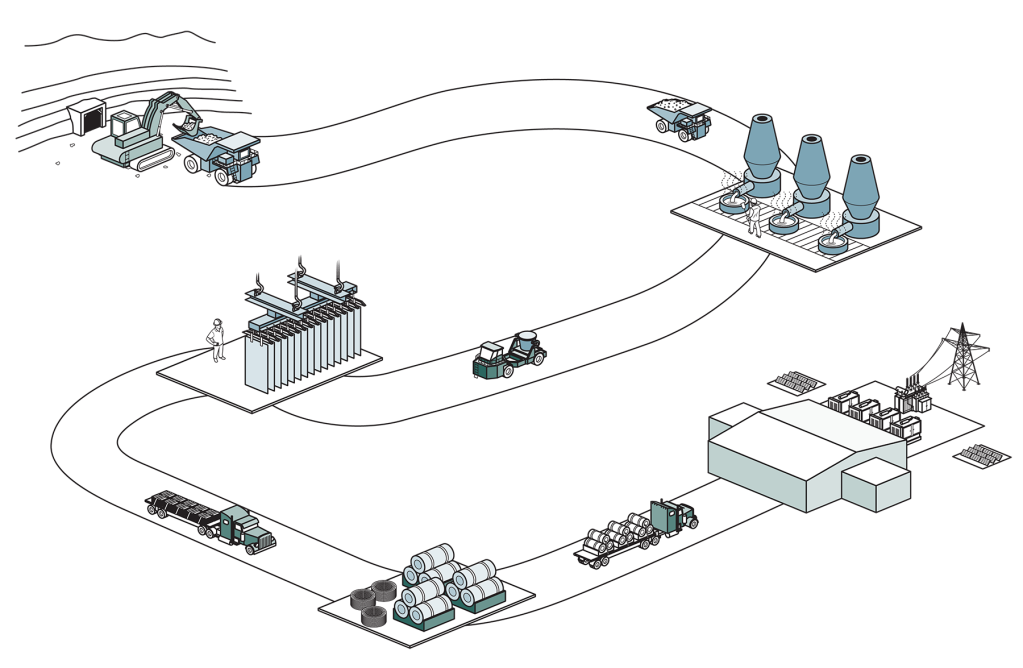

FIGURE 3

Efforts to Strengthen U.S. Tech Competitiveness

Apart from its international efforts, the United States has enacted domestic policies aiming to nurture and stimulate critical mineral mining, processing, and refining within its borders — resources foundational to AI infrastructure, semiconductor fabrication, and data center buildout. By 2024, these initiatives had spurred $120 billion in corporate investments in battery, semiconductor, and critical minerals supply chains, indirectly supporting AI development by ensuring availability of essential materials. Washington State has directly benefited from these investments, including funding for two plants to produce silicon anode material for EV batteries: one constructed by Sila Nanotechnologies and another by Group14. In addition, Group14 has received a second grant for a facility to produce silane itself, a raw material needed for both Group14 and Sila’s anode processing. The timeline below summarizes major U.S. legislation and executive orders and their relevance for AI.

Data sources: Department of Commerce, Federal Register, U.S. Federal Archive, Congressional Research Service, USGS, U.S. Congress, Gravel2Gavel (2025), Governor of Washington, Washington State Legislature, CNN (2025), The White House

Regulations and Implications of the Critical Minerals Challenge in Washington State

While Washington State does not produce critical minerals used in AI or clean energy technologies, its economic landscape places it at the forefront of the critical minerals challenge. As home to the ninth-largest data center market in the United States by energy consumption and hosting prominent tech giants such as Microsoft and Amazon, Washington’s economic health significantly depends on multiple sectors that compete for limited critical mineral resources. Beyond AI, the state is also a national hub for aerospace manufacturing — home to Boeing and a network of advanced manufacturing firms — which relies heavily on minerals like titanium, aluminum, and rare earth elements for aircraft components and propulsion systems. Together, these overlapping demands heighten the state’s exposure to global supply risks.

As a major consumer, Washington has an opportunity to shape solutions to the critical mineral crisis. These efforts include engaging the public on mineral dependencies, evaluating resource trade-offs, and investing in innovations to reduce impacts. The state can leverage its strengths in computing and materials research to develop earth-abundant alternatives, expand recycling, and build public-private partnerships for new processing or substitution technologies. Advocating for procurement standards and federal policies that prioritize responsible sourcing will help ensure its consumption does not worsen environmental or human rights harms. Washington could champion models like that of the Responsible Battery Coalition, which advances the responsible management of batteries throughout their entire life cycle, even mandating that state contractors join such a coalition. Following Ontario’s example, Washington could also establish revenue-sharing agreements with tribal nations for any mineral development, with First Nations holding 25 percent equity stakes and co-management authority. By leading in these areas, Washington can set a precedent for consumer-driven stewardship and systemic change in critical mineral supply chains.

Copper, in particular, stands out as one of the most contested minerals in Washington State due to its indispensable role in powering data centers, electric vehicle infrastructure, and energy generation and transmission systems, including hydropower turbines. Newly included on the 2025 Draft List of Critical Minerals, copper’s designation could enable more strategic policy interventions and incentives, promoting sustainable supply chain practices and stimulating domestic production.

Given its unique economic profile and exposure to supply constraints, Washington State’s policy decisions regarding critical minerals carry significant weight, potentially influencing national policies and setting a precedent for other states. In recognition of these responsibilities, the state enacted a pioneering battery stewardship law in 2023 and a solar panel stewardship law in 2025. Specifically, Washington could enact a “Semiconductor Stewardship Act” by 2026, requiring tech companies to fund recovery of gallium and germanium from discarded devices, with targets of 30 percent recovery by 2030. For copper, the state could establish a “Circular Copper Initiative” modeled on Japan’s urban mining program, which recycles critical minerals from urban waste. This legislation mandates producers to finance the collection and recycling of portable batteries containing essential minerals such as lithium, cobalt, and nickel, directly addressing the circular economy and sustainability dimensions of the critical minerals debate.

Richland, Washington, further cements the state’s leadership role in confronting the critical minerals issue through the research conducted at the Pacific Northwest National Laboratory (PNNL), a joint project with the University of Washington that was previously funded by JCDREAM. PNNL has emerged as a center of innovation, developing advanced methodologies to recover valuable minerals like neodymium from electronic waste. These efforts provide promising avenues to enhance resource efficiency and reduce dependence on primary extraction methods.

Ongoing research at PNNL is investigating the potential extraction of REEs from rapidly growing marine algae known as “biological ore.” This innovative approach could offer a sustainable, scalable alternative to traditional mining practices, significantly mitigating environmental impacts and offering a path forward for Washington State to help address critical mineral shortages more effectively. Other projects that received grants from JCDREAM include the Center for Rational Catalyst Synthesis, which aims to develop catalysts (materials that make chemical transformations possible to produce a wide variety of products) from earth-abundant materials; and Materials Washington, a statewide consortium of community and technical colleges enhancing materials education and workforce training. These initiatives are examples of a growing innovation ecosystem in Washington focused on reducing reliance on scarce minerals.

Through targeted regulatory frameworks, innovative research, and robust recycling initiatives, Washington State continues to navigate the complexities associated with critical mineral dependencies. These efforts not only bolster the state’s economic resilience but also establish benchmarks for other regions grappling with similar challenges, emphasizing sustainability and strategic resource management.

Recommendations for Forging Diverse and Reliable Critical Mineral Supply Chains

The dawning AI era is poised to make critical minerals even more indispensable — not only for the advanced microchips that drive AI systems but also for the immense quantities of carbon-free energy needed to power AI responsibly while meeting climate, energy, and environmental goals. Like the United States as a whole, Washington State increasingly depends on these minerals to sustain its economy, technological leadership, and security. However, mining and processing of critical minerals remain highly geographically concentrated or dominated by geopolitical competitors, raising the risk of supply chain disruptions.

Cross-sectoral collaboration to address these vulnerabilities can pursue four broad lines of effort: expanding responsibly sourced mineral supplies, friendshoring mineral processing, investing in supply chain resilience, and scaling up mineral recycling efforts.

Washington State could establish a Critical Minerals Task Force in collaboration with the U.S. Department of Commerce, with participation from Microsoft, Amazon, Boeing, PNNL, academia, and Indigenous communities. The Task Force would deliver: (1) a mineral dependency assessment; (2) pilot recycling programs for gallium, germanium, and copper; (3) state procurement standards requiring 25 percent recycled content; and (4) feasibility studies for creating a Pacific Northwest Critical Minerals Alliance by the end of 2026.

Expanding reliable supplies of AI-critical minerals

Develop a strategic roadmap for copper stewardship. As a leading consumer, Washington State could convene regional stakeholders and federal agencies (e.g., U.S. Departments of Energy and the Interior) to develop a strategic roadmap for copper demand management, recycling, and responsible procurement that accounts for social and human rights impacts. It could also assess in-state copper refining or alloy processing feasibility, leveraging its research institutions to pilot advanced refining or substitution technologies. Below is a roadmap it could follow:

- Phase 1 (2025–2026): Conduct a comprehensive copper flow analysis mapping the state’s e-waste and identifying recoverable copper currently landfilled. Partner with corporate technology partners to pilot copper recovery from decommissioned data center equipment. Establish procurement standards requiring contractors to disclose copper sources.

- Phase 2 (2026–2027): Launch a feasibility study for converting the former ASARCO Tacoma smelter site into a copper recycling hub, leveraging millions in federal infrastructure funds and creating hundreds of jobs. Partner with PNNL to develop copper-reduced alternatives for data center cooling systems.

- Phase 3 (2027–2028): Scale successful pilots to statewide implementation. Establish the nation’s first Responsible Copper Certification program, with third-party audits verifying environmental and labor standards.

Create a national stockpile of critical minerals, modeled after the Strategic Petroleum Reserve. Given the centrality of critical minerals to the modern U.S. economy and national security, as well as the high likelihood of future supply disruptions, a national reserve would stabilize markets through strategic buying and selling. In December 2023, the House Select Committee on the Chinese Communist Party endorsed this concept under the name “Resilient Resource Reserve.” Similarly, in February 2024, the IEA announced plans for a mineral security program specific to the energy sector. However, meeting AI and semiconductor needs would require an even broader scope to ensure adequate supplies for advanced technologies.

Washington State could host a Pacific Northwest planning conference with federal, tribal, and private partners to identify regional contributions to national stockpiles, assess in-state storage, and develop strategies for recycling, substitution research, and supply chain transparency. For example, a conference at PNNL could convene the Departments of Defense and Energy, regional tribes, major tech companies, and, critically, participation from mining-affected communities in the DRC, Indonesia, and Chile to ensure their voices shape solutions. Key deliverables would include: mapping recoverable minerals in regional e-waste, identifying storage sites, and establishing ethical sourcing protocols requiring community benefit agreements for any supply chain Washington companies utilize. The forum would be most effective by prioritizing solutions that uphold the dignity of mining-impacted communities worldwide, reinforcing Washington’s commitment to ethical supply chains through concrete accountability measures rather than voluntary guidelines.

Streamline responsible domestic mine permitting and capability development. Domestic mining of critical minerals faces a complex thicket of federal, state, and local permitting processes. Building a new mine in the United States can require up to 30 permits and take an average of 29 years, with duplicative and inefficient processes adding further delays. The “Unleashing American Energy” executive order has already initiated significant changes to this process, directing the Council on Environmental Quality (CEQ) to rescind NEPA regulations and expedite permitting processes. While these federal actions may reduce timelines from 29 years to potentially 10 to 15 years, they also risk eliminating crucial environmental safeguards and community consultation requirements. Washington State can respond by adapting state-level protections to fill gaps left by federal oversight, establishing tribal consultation protocols, requiring groundwater monitoring post-closure, and maintaining appropriate reclamation bonds.

In Washington, targeted State Environmental Policy Act (SEPA) reforms could complement federal permitting streamlining by establishing clear statutory timelines, adopting programmatic environmental impact statements to replace fragmented project reviews, and creating a centralized permitting office or lead agency to reduce duplicative assessments. These steps would help meet rising mineral demands while maintaining environmental and community protections.

However, any streamlining will merit robust safeguards to ensure that accelerated permitting does not come at the expense of environmental protection or the rights and well-being of local and Indigenous communities. Incorporating early and meaningful community consultation, cumulative impact assessments, and transparent accountability mechanisms will be essential to balance speed with sustainability.

Harness AI’s data-processing capabilities in the critical minerals sector. As highlighted in prior sections, this approach offers companies strategic advantages in the critical minerals sector, including reduced supply risks, enhanced efficiency, and stronger market positioning. The mining industry can leverage AI to analyze vast datasets to identify deposits, accelerate exploration, optimize permitting, and improve extraction yields through predictive maintenance. Developing proprietary AI models builds valuable intellectual property. The federal and state governments can support the industry by advancing data-sharing partnerships and regulatory reforms to further integrate AI into permitting and shorten approval cycles. Realizing these benefits requires strategic industry investment and streamlined, enabling regulations from the public sector, signaling proactive risk management to investors and strengthening firms’ leadership in AI and clean energy transitions.

Friend-shoring the “midstream” of critical minerals processing and refinement

China’s dominance in global critical minerals supply chains is most pronounced in the so-called “midstream” — the refining and processing of minerals after extraction. Although China produces only about 10 percent of the world’s cobalt, lithium, and nickel, it processes between 60 and 90 percent of these minerals, maintaining control through substantial state support. Processing profit margins remain low, and recent price declines have led to delays or cancellations of U.S. processing projects, despite their eligibility for up to USD1 billion in grants.

Subsidize critical mineral processing in the United States and allied nations. To compete with China’s entrenched advantages, additional federal financing may be needed to incentivize development of processing facilities both domestically and in partner countries. One potential approach is establishing an Investment Tax Credit (ITC) for mineral processing and refining projects not only within the United States, but also in allied nations. Unlike current IRA tax credits, such incentives should extend to mineral-rich countries outside formal free-trade agreements, such as Argentina, Brazil, India, South Africa, and Tanzania, to diversify sources of refined inputs.

Implement minimum price guarantees to derisk investments. Another policy tool is a minimum price guarantee, whereby the U.S. government agrees to cover the difference if market prices for critical minerals fall below a set threshold. However, a more strategic approach would use price floors as triggers for stockpile purchases rather than simple subsidies. When gallium falls below USD400/kg, or germanium below $1,400/kg, the government could automatically purchase predetermined quantities for the national strategic reserve — for example, acquiring 10 tons of gallium and 5 tons of germanium annually during price downturns. Even when prices remain above this floor, the backstop would help derisk long-term investments, enabling processors and refiners to secure purchase agreements more easily, knowing the government will prevent catastrophic price collapses while simultaneously strengthening national security through strategic reserves.

To ensure such guarantees do not simply subsidize noncompetitive operations, they can be carefully structured to support firms that meet high standards for environmental sustainability, labor protections, and community engagement. When tied to responsible mining practices, price guarantees can serve not only as an industrial policy tool but also as a mechanism to promote safer, more ethical, and more community-conscious supply chains, especially in jurisdictions where such standards are costlier to uphold than in countries like China.

Increase research and development for semiconductor-critical mineral refining. While the Departments of Energy and Defense currently fund R&D targeting critical minerals used in electric vehicles and clean energy — through programs such as the Critical Minerals Innovation Hub and the Minerals and Materials Supply Chain Facility — there is less focus on the minerals essential for semiconductors and AI. However, more recently, research in this area is gaining traction: the U.S. Department of Energy committed up to USD 6 million to support research and development for gallium recovery and advanced extraction technologies, with the goal of building a secure domestic supply for gallium.

The struggling REC Silicon plant in Moses Lake presents both a cautionary tale and an opportunity. With the facility no longer financially viable for polysilicon production, leaving only a few other U.S. suppliers (e.g., Hemlock Semiconductor in Michigan and Ferroglobe), Washington State could explore repurposing this infrastructure for gallium or germanium refining.

Developing domestic refining capabilities for gallium, germanium, silicon, and similar minerals will require further investments, potentially coordinated by the U.S. Department of Commerce, to advance technologies, infrastructure, and workforce expertise. In support of this goal, the Washington State Legislature has recently resolved to deepen its role as a center of excellence for research into sustainable substitutes for critical minerals, positioning the state as a potential leader in these innovation efforts. JCDREAM was the first initiative of this kind in the U.S. and Washington State can continue to lead in advancing sustainable technologies by investing in similar pioneering research and deployment initiatives.

Investing in critical mineral supply chain resilience

Ensuring a secure and reliable critical minerals supply chain will require proactive investments in resilience to mitigate geopolitical and market risks.

Reform the Development Finance Corporation (DFC) to enable flexible support for critical mineral projects abroad. The DFC plays a vital role in mobilizing private capital for projects advancing U.S. foreign policy interests, offering political risk insurance, loan guarantees, enterprise funds, and other contract assurances that reduce the inherent risks of investing in mineral-rich, but often politically complex, regions. The Corporation can also provide grants for technical assistance or feasibility studies to identify and plan critical mineral development. However, despite this broad mandate, only 12 of the DFC’s 1,008 active projects as of March 2024 were in mining and quarrying sectors directly supporting critical mineral production.

One key barrier is the DFC’s prioritization of lower-income countries. Currently, it requires a special waiver to invest in middle- or upper-income nations such as Turkey and Brazil, which possess significant graphite and nickel reserves, and is entirely barred from investing in high-income countries like Chile and Australia despite their abundant bauxite, lithium, and zinc deposits, which are resources critical for AI and semiconductor supply chains. Relaxing these restrictions would allow the DFC to deploy its full capabilities in support of U.S. and allied mineral security. As Congress considers DFC reauthorization, it could pursue reforms to expand its maximum contingent liability from USD60 billion to USD100 billion across all projects, eliminate the requirement for Congressional approval of deals larger than USD10 million, and strengthen metrics of success to better align with national strategic interests.

However, these expanded authorities must also be accompanied by strong due diligence, transparency, and accountability measures to ensure that funded projects adhere to international best practices, such as the International Finance Corporation’s Performance Standards or the Initiative for Responsible Mining Assurance (IRMA). Embedding these standards can help ensure that U.S. investments support not only strategic goals but also sustainable and socially responsible mineral development.

Enhance crisis planning and response for sudden mineral supply disruptions. The high dependence on geopolitical rivals for AI-critical minerals raises the risk of abrupt supply interruptions, whether due to military conflict, trade wars, or global emergencies such as pandemics. Planning and rehearsing contingency operations at federal, state, and industry levels can minimize these disruptions. In December 2024, for instance, the IEA conducted preparedness exercises with member governments under its Voluntary Critical Minerals Security Programme. Expanding such simulations to include state governments, private-sector actors, and civil society stakeholders would improve readiness and adaptability across the mineral supply chain.

Scaling up mineral recycling efforts

In addition to expanding and securing mineral supply, scaling up mineral recycling efforts is essential to maintaining balanced, sustainable, and resilient supply chains.

Recycling and reusing critical minerals can significantly reduce the need for new mining. For example, silicon wafers can be chemically etched to remove damaged layers for reuse, while hydrothermal buffering can recover gallium and arsenic from used semiconductors. Functioning chips can also be repurposed for new applications, extending their lifecycle. The IEA estimates that ramping up recycling could reduce the growth in new mining supply for critical minerals by 25 to 40 percent by 2050, including AI-critical minerals like copper. State and federal tax credits for recycling initiatives could incentivize these efforts and accelerate market adoption. Washington State could also lead in establishing economically viable recycling incentives program for critical minerals. In addition, Washington could introduce a “Semiconductor Stewardship Act” by 2026, requiring tech companies to fund recovery of gallium and germanium from discarded devices. For copper, the state could establish a “Circular Copper Initiative” patterned after Japan’s urban mining program, which recycles critical minerals from urban waste. Through incentive programs, Washington can catalyze private sector investment in critical mineral recycling and lead the country in critical mineral supply sustainability.

However, realizing the full potential of recycling will require overcoming significant economic and logistical hurdles. The business case for mineral recycling depends on feedstock availability, collection logistics, and economic viability. Although global e-waste exceeded 62 million tons in 2022, only 22 percent was formally recycled, limiting accessible feedstock. For high-purity minerals like gallium, germanium, and palladium, concentrations in e-waste can justify specialized recycling facilities, especially with rising prices and supply risks. Still, tight profit margins persist due to high capital costs, energy use, and extraction complexity. A 2024 IEA analysis found very high recovery rates for some metals, but economic returns remain constrained without policy incentives, streamlined collection, and guaranteed high-purity feedstock. Scaling recycling will require coordinated action by manufacturers, recyclers, and policymakers to achieve industrial viability.

Looking Ahead

The explosive growth of artificial intelligence has intensified the challenges surrounding critical minerals. Data centers and advanced semiconductors that underpin the AI boom depend on secure supplies of diverse mineral products, increasing pressures on an energy sector already strained to meet its own mineral requirements. Addressing this complex challenge will require sustained collaboration among international, federal, state, and local stakeholders, balancing economic priorities with national security and environmental stewardship.

As mineral demand surges, it is vital that efforts to expand mining, refining, and recycling are guided by strong environmental and social safeguards, particularly for Indigenous and frontline communities most affected by extraction activities. Ensuring transparency, accountability, and meaningful local participation will be critical to building resilient and equitable supply chains.

By pursuing the recommendations outlined above, Washington State, the U.S, and allied nations can bolster their mineral security, reduce the risks of supply chain disruptions, and position themselves as global leaders in a critical minerals economy that advances technological innovation, economic opportunity, and climate resilience — without compromising environmental integrity or community well-being.

By Alex Leader (Affiliate Researcher), Andrew Doris (Senior Policy and Research Analyst), Angeli Juani (Senior Policy and Quantitative Analyst), and Allison Carlson (Executive Vice President, FP Analytics & FP Events). Art direction by Sara Stewart, lead illustration by Andrei Cojocaru, graphics illustrations by Colin Hayes.

This issue brief was produced by FP Analytics, the independent research division of The FP Group, with support from JCDREAM. FP Analytics retained control of the research direction and findings of this issue brief. Foreign Policy’s editorial team was not involved in the creation of this content.

.